Executive Summary

| Standard | Date | Content |

| Decree No. 2530/2024 | September 17, 2024 | The Executive Branch included aluminum alloy profiles in the National List of Exceptions (“NLE”) to the Common External Tariff (“CET”) and increased the National Import Tariff (“NIT”) for their importation. |

| General Resolution No. 19/2024 | September 13, 2024 | The National Directorate of Tax Revenues (“DNIT”) established the beginning of the voluntary adhesion phase for small taxpayers as electronic billers. |

| Binding Consultation | July 2024 | The DNIT analyzed the Non-Resident Income Tax (“INR”) levy on the consulting services of a Chilean company under the Double Taxation Treaty (“DTT”) between Paraguay and Chile. |

| Binding Consultation | July 2024 | The DNIT expressed its opinion on the crediting of income tax (“ITx”) withholdings from abroad against Corporate Income Tax (“IRE”). |

More information

► Decree No. 2530/2024 - NIT for aluminum alloy profiles was increased.

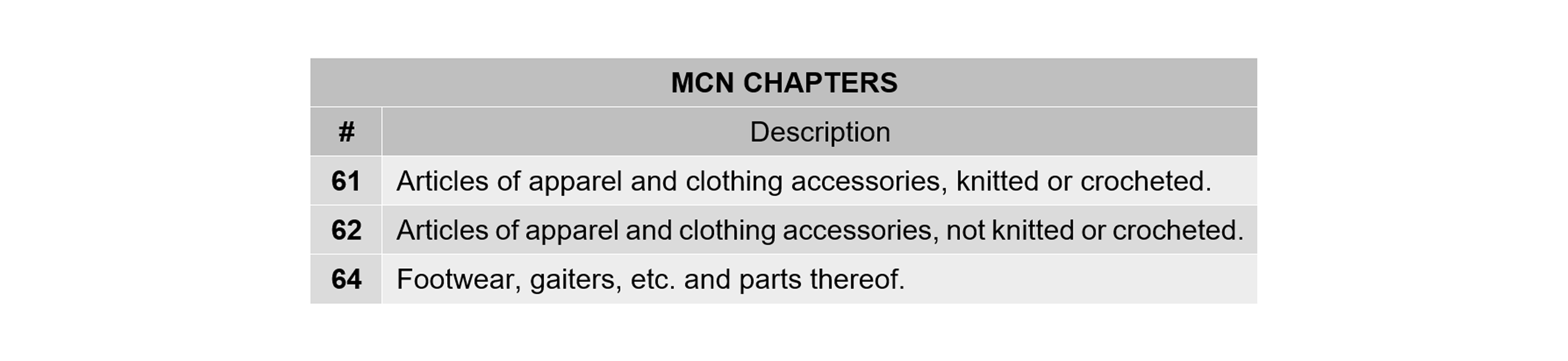

By means of Decree No. 2530/2024 (“Decree”), the Executive Branch amended the Annex to Decree No. 6897/2022 and its amendments, which incorporated into the national legal system the latest version of the Southern Common Market’s (“Mercosur”, by its Spanish acronym) CET and consolidated the NLE containing the tariff levels to be applied to imports originating from Countries that are not part of, or do not have a tariff agreement with Mercosur.

The NLE contains the NIT’s tariff items that differ from the CET, but only for each Country. Normally, the inclusion of a tariff item of the Mercosur’s Common Nomenclature (“MCN”) in the NLE implies that the NIT will be lower than the CET, thus seeking to encourage the importation of such goods. However, the opposite may also occur: the inclusion of a tariff item in the NLE implies an increase in the NIT with respect to the CET, thus making the importation of the affected goods more expensive as a measure to support their domestic production.

In this case, the Decree did just the latter, since it included aluminum alloy profiles in the NLE to make their importation more expensive, raising the NIT rates applied to them from 10.8% to 14%. For this purpose, it first excluded from the LNE two other items that already had the CET at 0%, as follows:

The increase of the NIT on imports of aluminum alloy profiles is expected to take effect on two different dates:

- In general, by the day following the publication of the Decree in the Official Gazette, which has not occurred yet, at least not until Official Gazette No. 204 dated October 14, 2024 (nor is the increase verified in the import tax calculator of the DNIT, available here).

- Exceptionally, after 60 days from the publication of the Decree in the Official Gazette, for import dispatches corresponding to goods in the following situations:

- destined for national customs territory and loaded on the transports;

- in a Paraguayan primary customs zone; or

- acquired before the general effectiveness of the Decree by contract, invoice or legal receipt that proves it.

This measure of support for local aluminum production seeks to grant equitable market conditions to this domestic industrial sector that has been catalogued in the Decree as vulnerable to practices that distort international trade. It complements another measure of support to the domestic metallurgical industry in public procurements, established by Decree No. 2522/2024 (which has also not been published in the Official Gazette until the most recent issue, mentioned above).

► General Resolution No. 19/2024 - The voluntary adhesion phase begins for taxpayers who wish to become electronic billers through the Ekuatia'i system.

By means of General Resolution No. 19/2024 (the “RG-19”), the DNIT established the beginning of the voluntary adhesion phase to the Ekuatia'i system as from October 1, 2024, for those taxpayers who wish to issue their invoices electronically. Those who have the following characteristics, in addition to complying with the general requirements to access the Ekuatia'i system, will be able to access this phase:

- Be a natural person.

- Be in the DNIT’s category of small taxpayers.

The general requirements to access the Ekuatia'i system are: (3) to have a single commercial establishment and (4) a single point of dispatch declared in the Single Taxpayer Registry; since this is free software that the DNIT has made available to those taxpayers who do not have a high turnover.

Taxpayers who comply with the above can join the Ekuatia'i system, regardless of the tax they pay and the invoicing method they currently use. To do so, they must follow the procedures below:

- Obtain the Qualified Electronic Signature Certificate (“QESC”), which is a free procedure that is done in person before the DNIT, whose requirements are established in General Resolution No. 757/2024, which we talked about in another publication, which you can access by clicking here.

- Request, on a one-time basis, the authorization as electronic biller, as provided for in General Resolution No. 6/2024 (“RG-6”), whose approval generates the electronic stamping number (which is unique and perpetual) and the Taxpayer's Security Code, all of which we have discussed in another publication, which you can access by clicking here.

- To cancel the stamping of the other means of generating invoices and other tax receipts, except for the virtual withholding voucher.

The procedures of paragraphs (b) and (c) must be carried out within 60 days after obtaining the QESC. The authorization as an electronic biller can be obtained independently of the procedure in paragraph (c). After said term, the adherent to the Ekuatia'i system is obliged to issue all its vouchers electronically (except for the virtual withholding voucher), so that non-compliance with this last procedure within the term indicated will cause the DNIT to carry it out ex officio and sanction the taxpayer with a fine of Gs.50,000 (~USD 6.30) for minor offences.

Finally, RG-19 established an extension until October 31 of this year for the application of penalties to taxpayers selected to obligatory adhere to the Ekuatia'i system who have been issuing invoices and other vouchers by means other than this one, beyond the term outlined in Article 27 of RG-6. After that date, a fine of Gs.50,000 will be applied for each voucher or document that is not issued through the Ekuatia'i system, which will be accumulated up to the maximum fine for minor offences (currently Gs.1,530,000, or ~USD 200) for each monthly period.

The complete list of taxpayers mandatorily designated as electronic billers through the Ekuatia'i system can be found in the annex to General Resolution No. 06/2024. Which can be consulted here.

► Response to Binding Consultation – INR to the consulting services rendered by a Chilean company in the context of the DTT between Paraguay and Chile.

In response to a binding consultation in July of this year, the DNIT analyzed the INR levy on consulting services that a legal entity from Chile would provide to Itaipu Binational on the pre-feasibility and feasibility of a railway project to be used in the country, which would have a total duration of 195 days, of which only 24 days would be with physical presence on the site located in Paraguay, while the rest of the days the services would be provided remotely from Chile.

In this regard, the DNIT clarified that it is important to demonstrate that the provider of consulting services is a tax resident of Chile, for which it must obtain and present to its local client the certificate of tax residence issued by the competent authority of that country (Internal Revenue Service, or SII by its Spanish acronym) with all the data required by Article 7 of General Resolution No. 65/2020 of the former Undersecretariat of State for Taxation.

Having clarified this, the DNIT proceeded to classify the consulting services as “Business Profits” under Article 7 of the DTT between Paraguay and Chile, which are only subject to taxation in the country of residence of their supplier (in this case, Chile), unless they are rendered through a permanent establishment in the other country of the DTT (in this case, Paraguay). A permanent establishment would only be formed, under Article 5 of the DTT, if there is a fixed place of business in the country of supply of the services, or company's employees provided their services in the country for more than 183 days in any 12-month period.

Consequently, the DNIT concluded that in the case of the applicant, the consulting services are classified as “Business Profits” under the DTT and they are not provided through a permanent establishment, so INR withholding does not apply, since they should only be taxed the ITx in Chile. However, if the services were to be rendered through a permanent establishment in Paraguay, INR withholding would not be applicable either, since that establishment should be registered as an IRE taxpayer and settle such tax.

► Answer to Binding Consultation - Credit of ITx withholdings from abroad against IRE.

In response to a binding consultation during July of this year, the DNIT clarified several issues regarding the crediting of ITx withholdings from abroad against IRE. This institution specifically referred to (1) the methods to relieve international double taxation of ITx that are recognized by domestic legislation, (2) the income benefited by such methods, (3) the limits of such reliefs and (4) the procedure to execute them.

Regarding the methods for international double taxation relief, the DNIT clarified that they are necessary only when the tax sovereignty of 2 States concur: the State of source or place of generation of income (“SS”), and the State of residence of the taxpayer (“SR”). In this case, although Paraguay may exercise its tax sovereignty over income obtained outside the country, it prioritizes the tax sovereignty of the SR over them, applying one of the following 2 methods to eliminate double taxation: exemption or tax credit.

Although the DNIT only refers to the tax credit method, the fact is that Law No. 6380/2019 (“Tax Law”) also recognizes the exemption method when the taxpayer pays on the affected income an ITx at a rate equal to or higher than the IRE’s 10%; applying the tax credit method, in principle, only when the ITx rate from abroad is lower than IRE’s. Both methods would be limited to income from abroad activities that are not included in any of the items of Article 6 of the Tax Law, thus excluding, in principle, ITx payments to other States for services and investments made from Paraguay.

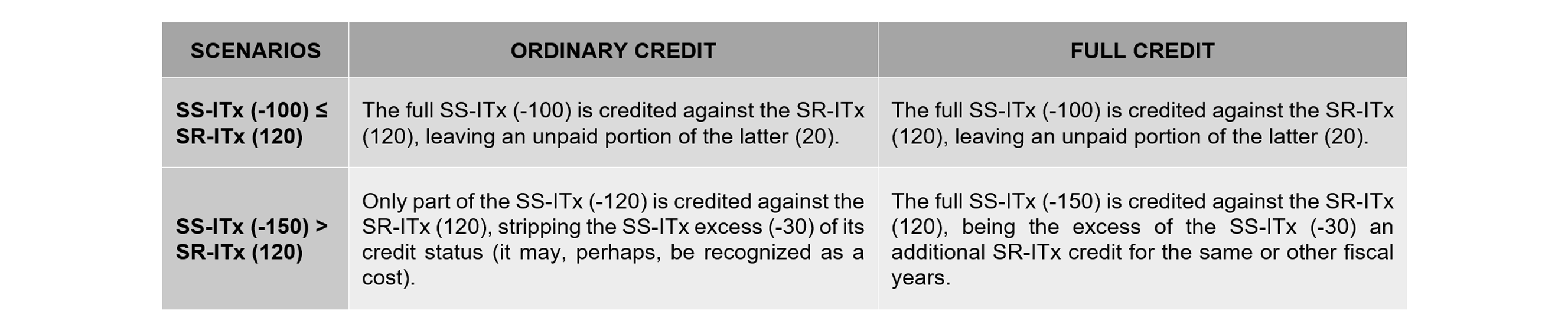

Specifically concerning the tax credit method, the DNIT implicitly refers to the species of (a) ordinary credit and (b) full credit, whose point of contact lies in the fact that both compare the ITx paid in the SS (“SS-ITx”) against the ITx that would be payable in the SR (“SR-ITx”), to credit the first against the latter. However, both differ in which amount prevails: the SR-ITx prevails in the ordinary credit method, while SR-ITx prevails in the full credit method. This gives rise to the following scenarios:

The DNIT emphasizes that the ordinary credit method is the one provided for in the Tax Law, and is the one that applies when there is no DTT; or when the DTT allows it, but if the DTT provides for the full credit method, then this is the one that will prevail, in accordance with the order of precedence of legal rules, as provided for in Article 137 of the Paraguayan National Constitution. This prevalence of the DTTs over the Tax Law also applies to the types of income provided for in the DTTs, to which the methods to relieve double taxation provided therein are applied, which may include the incomes foreseen in any of the numerals of Article 6 of the Tax Law, among others.

Finally, regarding the procedure to recognize the ITx paid abroad as a tax credit in the IRE’s settlement, the DNIT pointed out that this does not occur freely and automatically in the settlement affidavit of said tax, but that, in all cases, the taxpayer must:

- Submit a note addressed to the National Director of the DNIT and file it through the entry desk, requesting the recognition of the ITx paid abroad and the enablement of box 109 “Income Tax paid abroad credited against IRE for double taxation relief” of Form No. 500 of the obligation 700-IRE General.

- Attach to the note the document that supports the payment of the ITx abroad, which would normally be the withholding voucher from abroad, plus the sale invoice issued and stamped by the DNIT that supports the services or activity abroad. However, the General Management of Internal Taxes may require other documents it deems pertinent.