Executive Summary:

On March 26, 2024, the National Directorate of Tax Revenues ("DNIT") issued General Resolution No. 06/2024 (the "Resolution"), which regulates the issuance of Electronic Tax Documents ("DTE") through the "Ekuatia'i" system.

This Resolution affects taxpayers who issue Virtual Tax Documents ("DTV"), since among them, a group of more than 900 taxpayers have been designated to use the Ekuatia'i system on a mandatory basis.

More information:

Before this Resolution, the taxpayers who are individuals rendering personal services and who are therefore subject to Value Added Tax ("VAT") and/or Personal Income Tax ("IRP"), could only choose to issue DTVs as an alternative to the traditional means of invoicing, a measure that was established by General Resolution No. 61/2015 (the "RG 61/15").

DTVs can only be issued using the software enabled by the DNIT for such purpose, known as "Tesaka", or through the DNIT's "Marangatú" System. They do not require for their issuance the proper encryption of qualified electronic signature, but only the authentication of the username and password of the taxpayer.

As of the Resolution, those same taxpayers will switch from DTVs to DTEs. When we talk about electronic receipts and DTE, in terms of the Resolution, we refer to those that have complied with the following characteristics:

- They are issued by an electronic biller authorized by the DNIT.

- They must be issued exclusively through the e-Kuatia or Ekuatia'i systems.

- They are subscribed with a qualified electronic signature, for which the issuer must have a Qualified Certificate of Electronic Signature (CCFE).

- The electronic receipts are validated by the Integrated Electronic Invoicing System ("SIFEN"), which approves them as DTE and grants them the corresponding tax validity.

Individuals often confuse DTVs with DTEs, due to the role played by information technology in the issuance of both. However, they correspond to different methods of issuing tax receipts, with different levels of validation, being the DTE and its issuing system (in this case, the Ekuatia'i) is a sort of improved version of the DTV and its issuance by the Tesaka or the Marangatú System.

Ekuatia'i was created to serve as a free electronic invoicing and receipt issuing system for small taxpayers, as opposed to the well-known e-Kuatia system, which was created for those taxpayers with a higher volume of invoicing and receipt issuing, who must integrate it into their own invoicing system or software.

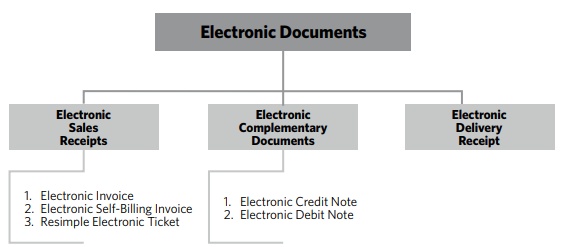

The Resolution also establishes the following types of vouchers that may be issued electronically through the Ekuatia'i, which are more than the DTV types, but much less than those that may be issued through the e-Kuatia:

- Electronic receipts and their graphic representation.

The generation and issuance of the DTE will be carried out through the Ekuatia'i system, through which the taxpayer must enter the information related to the commercial operation for the generation of the electronic document, sign it electronically and send it to SIFEN so that the CDC and QR code[1]can be generated on them. SIFEN will not receive those electronic documents whose date of issue exceeds thirty calendar days from the date on which it was generated in the Ekuatia'i system.

Electronic billers are obliged to print and deliver to their clients the graphic representation or KuDE[2] of the DTEs they issue, only when so required. Transactions documented with the DTEs provided for in the Resolution may only be expressed in guaraníes[3] or U.S. dollars, and in the latter case the exchange rate applicable to all or some items must be specified.

The Ekuatia'i system is responsible for sending the XML file[4] and the KuDE of the DTE by e-mail to the recipient of the DTE, provided that the recipient has a registered e-mail address in the Single Taxpayers Registry ("RUC") or declares it at the time of issuance of the DTE.

The KuDE must be generated for all the vouchers indicated in the invoicing scheme, which must have both the CDC and the QR code that the recipient can scan to consult the DTE data through the Ekuatia portal. It is important to mention that, although the KuDE is also valid for tax purposes, if the information on the KuDE differs from the DTE, the information on the DTE will prevail.

- Events.

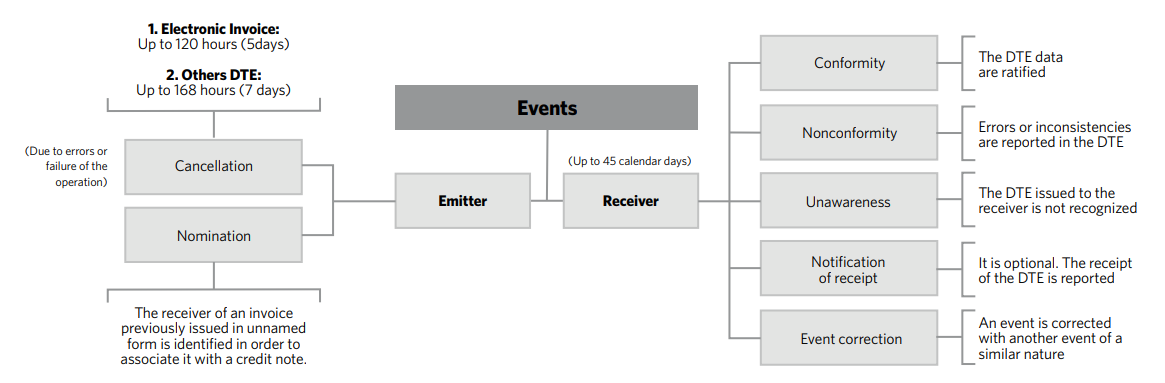

The events recorded within SIFEN that modify, assign a mark, link information, or affect the status of the electronic document and/or DTE are called "Events" in the electronic invoicing scheme. They can be generated by the issuer, the receiver, the DNIT, and even by SIFEN itself automatically, both before and after the approval of the DTE.

The Resolution only regulates the Events of the issuer and the receiver, without referring to those of the DNIT and the SIFEN, which are understood to be the same as those provided for in Decree No. 872/2023. The Issuer's and Receiver's Events provided for in the Resolution are grouped as follows (all deadlines are in hours and calendar days, and are counted from the approval of the DTE):

- Qualification as electronic biller.

Before the taxpayer can start issuing DTE through the Ekuatia'i system, the taxpayer must be authorized by the DNIT as an electronic biller. For this, the taxpayer must previously obtain the Qualified Certificate of Electronic Signature ("CCFE"), since all DTEs must have the electronic signature of the issuer. This procedure will be in accordance by the provisions of General Resolution 757/2024, about which we have written a previous article which you can access by clicking here.

Once the taxpayer has the CCFE, it must be up to date with its tax obligations and submit the respective request through the Marangatú system. This application will be analyzed by the DNIT, which will proceed within three business days to approve or reject it. If the request is approved, the DNIT will notify the taxpayer's Marangatú mailbox, send the security code for the generation of the QR code and register the stamping of electronic documents (which does not expire).

Once the taxpayer receives the DTE stamping authorization, it must enter the Ekuatia'i system and proceed to its configuration, according to the line of business of the taxpayer. The Ekuatia'i system may only be used by taxpayers with a single establishment declared in the RUC and with a single issuing point, as registered in the application for authorization as electronic biller.

If the taxpayer adheres to this system and would like to have a greater number of issuing points and/or establishments, it must adopt the e-Kuatia system (in case it wants to continue issuing electronically), or it can opt for pre-printed vouchers, first communicating the cancellation of the authorization as electronic biller and of the electronic stamping.

- Designation of obligated electronic billers.

Finally, the Resolution provides for the completion of the Pilot Plan for the implementation of the Ekuatia'i system and the gradual extension of its mandatory use. To this effect, taxpayers identified by their RUC numbers in the annex of the Resolution must manage a CCFE and electronic stamping in the month corresponding to their RUC termination, being obliged in the following months to issue only DTE, except for the virtual withholding voucher, according to the following calendar:

| Termination of RUC | Month to manage CCFE and electronic stamping | Date of mandatory issuance of DTE |

| 0, 1 y 2 | April 2024 | June 1, 2024 |

| 3, 4 y 5 | May 2024 | July 1, 2024 |

| 6, 7, 8 y 9 | June 2024 | August 1, 2024 |

This implies the obligation of the designated taxpayers to cancel the stamping of virtual vouchers within 60 calendar days of having obtained the electronic stamping. If they fail to do so within such term, the DNIT will do it ex officio, but it will imply the application of a fine of G. 50,000. Taxpayers obliged by the Resolution may issue the DTEs even before the mandatory date if they so wish.

In case you wish to find out if you are designated among the taxpayers obliged to issue DTE through the Ekuatia'i system, you can do so by accessing the document we have prepared that can be used to consult, for which you must click here.

[1] QR Code: It stands for "quick response" or quick response. It is a two-dimensional barcode included in graphic representations of documents whose scanning or reading by a device allows easy access to online information associated with it.

[2] KuDE: Term that has its origin from the fusion of the Guarani word "Kuatia" and the acronym DE, which stands for Electronic Document.

[3] The ticket “resimple” only admits the expression of the transaction in guaraníes.

[4] XML: stands for "eXtensible Markup Language" or Extensible Markup Language. It is a language that supports the exchange of information between computer systems, such as websites, databases, and third-party applications. XML is useful when several applications must communicate with each other or integrate information, as it allows compatibility between systems to share information in a secure, reliable, and easy way.