Executive summary:

| Standard | Content | Date |

| Decree N° 947 | The real estate tax values for the taxable base of the real estate tax and its additions, corresponding to fiscal year 2024, are established. | December 28, 2023 |

| Decree N° 872 | The issuance of electronic receipts through the Integrated National Electronic Invoicing System ("SIFEN") is regulated. | December 18, 2023 |

| Decreee N° 859 | Expands the customs declaration requirements in detail and the selectivity channels subject to controls after the customs operation. | December 18, 2023 |

| General Resolution No. 730/2023 | The National Directorate of Tax Revenues ("DNIT") exempts from penalties until April 30, 2024, the lack of confirmation of the receipt filing annual and monthly, established in General Resolution No. 90/2021. | December 29, 2023 |

| Latin American Tax Policy Guide | VOUGA Abogados has contributed to the drafting of the latest tax guide of the World Services Group ("WSG"). | December 22, 2023 |

More information

► Decree No. 947/2023 - Whereby the real estate tax values are set for the taxable base of the real estate tax and its additions, corresponding to fiscal year 2024.

By means of Decree No. 947/2023, the Executive Branch fixed the real estate tax values established by the National Cadastre Service ("SNC") of the Ministry of Economy and Finance, which will serve as the taxable base for determining the real estate tax and its additions for the fiscal year 2024.

The adjustment involves a 3.5% increase in real estate values for urban and rural properties based on the year-on-year variation of the Consumer Price Index ("CPI") at the end of October 2023, as issued by the Central Bank of Paraguay.

It is important to remember that the amount of the tax is determined by applying the corresponding rates (usually 1%) on the tax valuation of the real estate established by the SNC (taxable base), which is made up as follows:

- Urban real estate: Land value (m2 of the property per G/m2) plus building value (m2 of the buildings per G/m2). The G/m2 are determined by the type of pavement with the highest value of the property's adjoining streets (fronts) for the land value, and by the construction category for the buildings.

- Rural properties: Land value (hectare ("ha") of the property per G/ha). The tax valuation of each district is determined according to its opportunity cost (distances to urban centers and accessibility) and the predominant type of soil, according to the categories indicated in the decree.

It also provides, among other things, the valuation of properties that change from urban to rural category and vice versa, the procedure for the exemption of 50% of the tax for rural properties with forestry priority or with real right of forestry surface, and the discount for rural properties with low productive areas that differ from the type of soil of their district.

The amount of the tax to be paid to the municipality can be consulted through the SNC website, in the municipalities section, real estate tax liquidation section, subsequently selecting the department of residence, the district and the cadastral nomenclature of the property (cadastral register or current account).

Decree No. 872/2023 - Whereby the issuance of electronic receipts through SIFEN is regulated.

By means of Decree No. 872/2023 (the "Decree"), the Executive Branch regulated the issuance of sales receipts and other electronic tax documents through SIFEN from January 1, 2024, onwards. Thus, Decree No. 7,795/2017, by which the SIFEN was created, was abrogated since then.

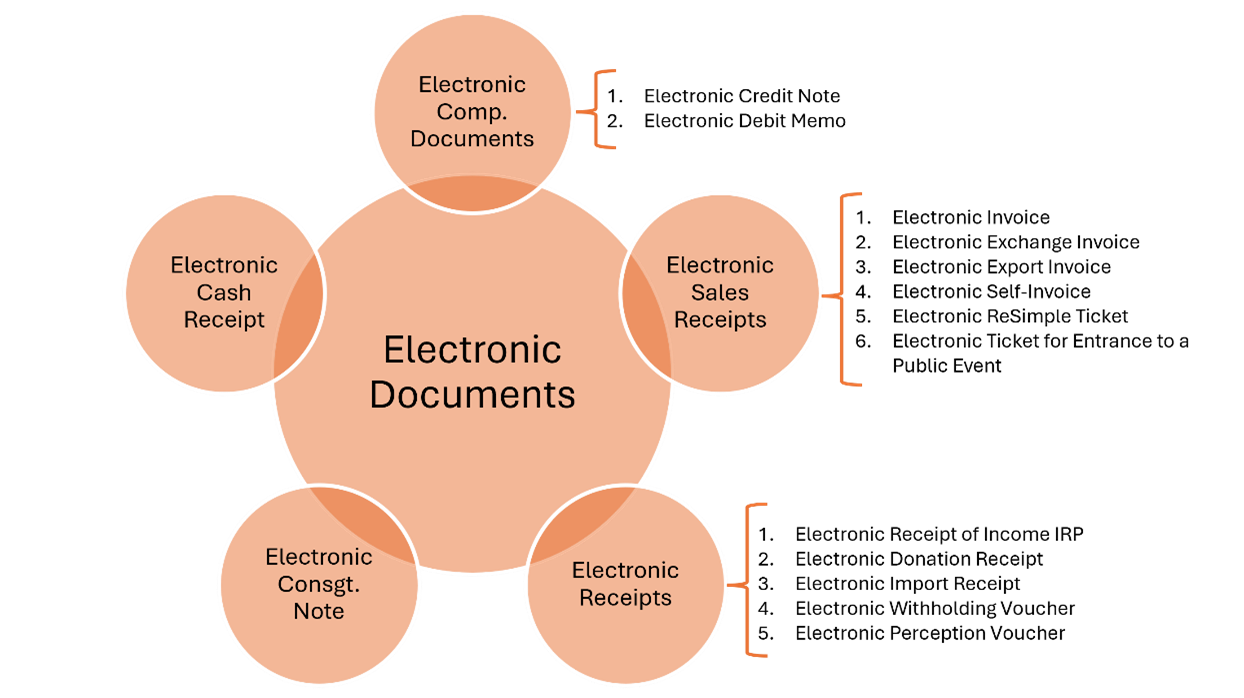

The Decree addresses the issues related to the electronic invoicing: (1) types of electronic documents, (2) processes related to them (generation, delivery, consultation, and conservation), (3) acts or events on such documents, depending on who performs them (issuer, receiver, SIFEN and DNIT), and (4) conditions to be an electronic invoicer. Regarding the classification of electronic documents, the Decree establishes the following groups, without prejudice that the DNIT may incorporate others:

The Decree includes several concepts already defined in General Resolution No. 23/2019 of the former SET and regulates aspects that were not fully clarified in the previous regulations governing electronic invoicing. Below, we mention some of the most relevant issues the Decree addresses.

Commercial transactions carried out by an issuer who is a natural or legal person are classified according to the concept invoiced and the quality of the recipient of the electronic document: (a) B2B if it is a taxpayer that does not act as the final consumer, (b) B2C if it is a natural person that acts as the final consumer, (c) B2E if it is a foreign person to whom goods are exported, (d) B2F if it is a foreign person that receives a service (the classification for the sale of goods abroad would remain in doubt), and (e) B2G if it is a public entity of Paraguay.

In none of these types of transactions is it allowed to issue an electronic invoice in unnamed form, i.e., in which the recipient is not identified except for B2C transactions that do not exceed the following amounts or their equivalent in foreign currency: (i) G. 35,000,000 as from January 1, 2024, and (ii) G. 7,000,000 as from January 1, 2025. This constitutes a reduction of the limit for issuing unnominated invoices in B2C transactions, since General Resolution No. 23/2019 had set it at USD 10,000 or its equivalent in guaraníes, except for deliveries of medical samples by importers or national laboratories, which were not subject to this limit.

The Decree also establishes requirements regarding electronic export invoices, which the exporting entity must issue before the formalization of the dispatch and departure of the goods from Paraguayan territory. The invoices will be used to support the cancellation of the definitive export affidavit.

An important figure introduced by the Decree is the electronic exchange invoice, which is defined as the electronic document generated as a credit title issued to an order payable by the purchaser of a good or service. Although the figure of the exchange invoice was already established through Law No. 6,542/2020, the Decree incorporates this figure (basically an invoice issued on credit) within the SIFEN, thus seeking to make it operative through this system.

It is also worth mentioning the creation of the electronic receipts of money, which document the payment in credit or term operations, as well as income of money for which there is no obligation to issue an invoice or other tax document. In credit or term operations, the receipt must be associated with the electronic invoice that supports it. The money receipt may not be used to support Value Added Tax ("VAT") credit, but it may be used to support income tax-related expenses, depending on the rules applicable to each tax.

Regarding the processes and events related to electronic documents, the Decree does not introduce substantial changes concerning what was provided for in General Resolution No. 23/2019 of the former SET. However, the introduction of new events can be observed, such as the nomination by the issuer (the recipient of an unnamed document is identified after issuance), the consent of the recipient for Electronic Credit Notes and the challenge of documents by the DNIT, also foreseeing the power of the latter to create new events for the SIFEN.

Finally, the Decree established the conditions that apply to those taxpayers who wish to register as electronic billers, which are: (i) acquire the qualified electronic signature certificate; (ii) possess a computerized billing system that allows the issuance, receipt and storage of electronic tax documents and their associated events; (iii) request authorization and stamping for electronic documents; (iv) request and obtain SIFEN authorization as an electronic biller; and (v) obtain the taxpayer's security code for the generation of the QR to be incorporated in the graphic representations of the electronic tax documents.

The DNIT is also empowered to designate taxpayers as electronic billers gradually, without prejudice that the interested parties may voluntarily become electronic billers. They will not be able to issue receipts or other tax documents by means other than electronic means from the date indicated by the DNIT, except in contingency cases.

► Decree No. 859/2023 - Whereby the customs declaration requirements in detail and the selectivity channels subject to controls after the customs operation are expanded.

By means of Decree No. 859/2023 (the "Customs Decree"), the Executive Branch amended Articles 170 and 331 of the Annex to Decree No. 4672/2005, which regulates the Customs Code, which deals with (1) the requirements of the customs declaration in detail and (2) the subsequent controls of the customs duty, respectively. This provision also abrogated Decree No. 2908/2019, which amended Article 331.

Regarding the customs declaration in detail, the Customs Decree expanded the information it must contain. Hence, it now also includes data relating to the persons responsible for and intermediaries of the freight. The obligation to attach the following documents to the customs declaration in detail was also added:

- Invoice or receipt for license or brokerage payments and other expenses related to the goods, which are part of the customs value of the goods, and which are not included in your invoice.

- Invoice or freight receipt issued by a national or foreign company with legal representation and legal status in the national territory, specifying the expenses and costs incurred.

- Invoice or proof of expenses and costs for handling, brokerage and other payments that are part of the customs value of the goods and that are not included in the invoice of the goods or freight.

- Proof of payment specifying the means and form of payment for the goods, by the legal regulations of the Secretariat for the Prevention of Money or Asset Laundering ("SEPRELAD").

It is important to remember that the detailed declaration must be filed even when the declared goods are affected by customs regimes or treatments not subject to the application of taxes or economic restrictions on imports or exports, whether exempt or exempted from them unless otherwise specified.

About subsequent controls of goods, the Customs Decree expands the selectivity channels whose goods are subject to them, as it provides that all selection channels are subject to such controls, including the red channel and no longer only the green and orange channels, as previously provided for.

Subsequent controls are performed after the release of the goods and are carried out at two (2) levels: (i) a first level of review of the declarations to verify the tariff classification, origin, valuation, and tax liquidation of the goods; and (ii) a second level of control of documents in the company itself, which includes computer systems, accounting records and warehouses linked to customs operations.

► Resolution No. 730/2023 - DNIT exempts from penalties until April 30, 2024, the lack of confirmation of the presentation of the receipt registry, established in General Resolution No. 90/2021.

By means of Resolution No. 730/2023 ("R-730"), the DNIT provided that, until April 30, 2024, it will not consider as tax non-compliance the failure to confirm the filing of the registration of receipts corresponding to:

- The annual registration of vouchers corresponding to fiscal years 2022 and 2023, under code No. 956 - REG. ANNUAL REG.

- The monthly register of vouchers corresponding to the fiscal periods from January to December 2023, and January and February 2024, under code No. 955- REG. MONTHLY VOUCHER REG.

This means that the lack of confirmation or late confirmation of the voucher registration voucher within the indicated period does not result in the application of a fine for contravention, nor the other negative consequences of non-compliance, such as: impossibility of generating the tax compliance certificate, increase of the taxpayer's risk index, among others.

This measure complements the provisions of the former SET in General Resolutions No. 124/2023, 126/2023 and 132/2023, as well as those of the DNIT in Resolution DNIT No. 403/2023, which had established this measure until December 31, 2023.

During the R-730's validity period, the DNIT will continue to receive the receipt registration and confirmation of the filing slip.

► Guide to tax policies in Latin America - VOUGA Abogados has contributed in the drafting of the latest WSG tax guide.

The WSG Tax Group has published its latest tax guide, "Navigating Tax Law Policies in Latin America”, which provides detailed country-by-country perspectives, updates, and trends regarding tax laws and policies in the region.

More than 35 tax experts from 17 Latin American jurisdictions contributed to the guide, a testament to the power of partnerships among WSG members and their highest expertise on crucial industry updates and trends.

In that sense, VOUGA Abogados has contributed to the guide with a chapter on Paraguay and its tax policies by our distinguished members, Rodolfo Vouga, Horacio Sanchez and Andrés Vera.

It is worth mentioning that the WSG is the foremost global network of independent law firms, providing a unique environment and platform to connect its members with the most elite law firms and their multinational clients worldwide. If you wish to consult the complete guide, you can do so through the following link.