Bill approving the loan agreements between ANDE and Kreditanstalt fur Wiederaufbau (KfW), for up to USD 75,000,000, and between ANDE and FONPLATA, for up to USD 45,000,000 ("Bill") for the financing of the construction project of the 220KV transmission line between Villa Hayes - Villa Real - Pozo Colorado - Loma Plata and the Pozo Colorado substation, Western Region ("Project")

A. Aspectos Generales

On June 15, the Senate (originating chamber) approved the Bill, thus initiating the second constitutional procedure before the Chamber of Deputies (revising chamber). Since June 22, 2023, the Bill has been under review by the Committees on Economic and Financial Affairs, Foreign Relations, Public Works, Public Services and Communications, Budget, and Accounts and Budget Execution Control.

The purpose of the Bill is to increase the capacity of the Northern and Western Transmission System and part of the Bajo Chaco Distribution System through the construction of a 220 KV transmission line, the Pozo Colorado Substation, and the construction of 4 new feeders in the influence area of the Pozo Colorado Substation.

The execution of the Project will be carried out by ANDE. The Works are part of ANDE's Short and Medium-Term Master Plan for Transmission, Distribution, Information Technology, and Communication, 2021-2030, and the Short, Medium, and Long-Term Master Plan for Generation, 2021-2040, by ANDE.

B. Financing

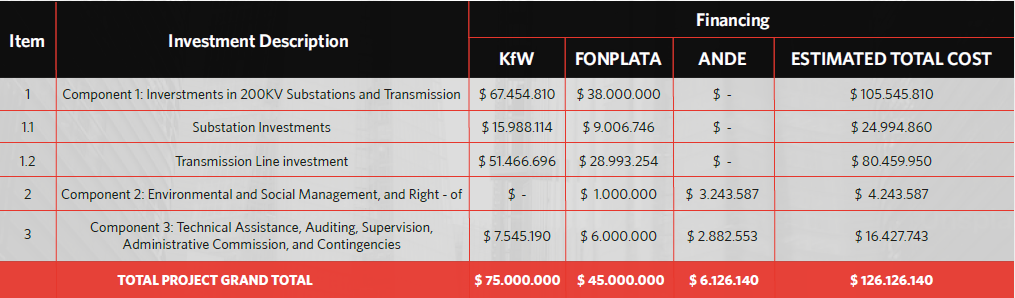

The total cost of the Project amounts to USD 126,000,000, with USD 75,000,000 financed by KfW and USD 45,000,000 by FONPLATA, with a local counterpart of USD 6,130,000 ("Loan").

It is important to mention that the components of the Project already have the code from the National Public Investment System (SNIP) of the Technical Planning Office, through which public investment projects are managed. It should be noted that the Project will result in a budget expansion of PYG 248,494,507,904, directly affecting ANDE's budget. The Bill provides for the possibility of a local counterpart for additional resources to the Loan, if necessary to complete the Project.

The USD 75,000,000 Loan provided by KfW is backed by a Sovereign Guarantee granted by the Republic of Paraguay and has an amortization period from May 15, 2027, to May 15, 2038.

Additionally, the loan with KfW provides that the parties will define, in a separate agreement, the details of the disbursement procedure and how ANDE must verify the use of the Loan, as well as the proportions and order of the respective disbursements under the loan agreement.

Regarding the USD 45,000,000 loan with FONPLATA, the loan contract establishes a repayment period of 20 years.

C. Project Structure and Contracting System

Project Structure and Procurement System

(a) Componente 1 (“Works”): Investments in 220 KV Substations and Transmission Lines:

- 220 KV transmission line between Villa Hayes and Villa Real, consisting of a rural single-circuit of 200km and a section of double-circuit line of approximately 25km, including the crossing of the Paraguay River.

- 220 KV transmission line between Villa Real - Pozo Colorado - Loma Plata, consisting of a rural single-circuit of 343km and a 1km section of urban line near the Villa Real Substation.

- Pozo Colorado Substation at 220KV, including the supply and installation of 1 three-phase 220/23KV transformer with a capacity of 50 MVA.

- Construction of 4 feeders and reinforcements.

(b) Component 2: Environmental and Social Management, and Right-of-Way Clearing.

(c) Component 3: Technical Assistance, Auditing, Supervision, Administrative Commission, and Contingencies.

According to the background information of the Project, the Loan will be executed as follows:

Regarding the project's contracting method, the Project Law establishes that contracts for the project's execution will be carried out using the International Public Bidding system in accordance with local law, while consultancy services will be procured in accordance with the current regulations on public tenders and the "Policies for the Acquisition of Goods, Works, and Services in Operations Financed by FONPLATA of July 2017".

D. Final Comments

The Project is a key endeavor for the country's medium and long-term development as it encompasses one of the most dynamic and promising growth regions, the Chaco. Ensuring energy security in the Chaco is crucial to guarantee a sustained pace of growth and development. Therefore, the approval of the loan by the Legislative Power is urgently needed to commence the works. In this regard, we anticipate that the bidding processes for the Project will commence in the second half of the year once the new government takes office.

The Project is already in its second constitutional process in the Chamber of Deputies. According to the latest information, the Budget Committee of this Chamber ruled in favor of the approval of the Project.

We will closely monitor the legislative process of file S-231893 of the Project Law and will provide updates on any relevant developments.

For further information on any of the topics covered in this edition of our newsletter, please contact our experts: Luis Marcio Toraleslmtorales@vouga.com.py); Silvia Benítez (sbenitez@vouga.com.py); Manuel Acevedo (macevedo@vouga.com.py); Rodolfo G. Vouga (rgvouga@vouga.com.py)