Executive Summary

| March 2025 | ||||

| Regulation | Date | Content | ||

| Executive Order No. 3465 | March 11, 2025 | Modifying the structure of the rules for the registration of persons involved in customs activities. | ||

| Decree N° 3473 | March 11, 2025 | Incorporation to the Paraguayan legal system of the amendments to the specific requirements of the Mercosur Regime of Origin ("ROM") for certain codes of the Mercosur Common Nomenclature ("NCM"). | ||

| Decree No. 3593 | March 26, 2025 | The Executive Power empowered the Ministry of Economy and Finance ("MEF") to incorporate to the national legal system the directives of the Mercosur trade commission approving temporary reductions of import tariffs. | ||

| Decree No. 3594 | March 26, 2025 | Incorporation to the Paraguayan legal system of the extension of the expiration of the export benefits between Mercosur and Bolivia. | ||

| General Resolution N° 26 | March 24, 2025 | The National Directorate of Tax Revenues ("DNIT") regulated the enrollment in the Purchasing Tourism Regime ("RTC"). | ||

| General Resolution No. 27 | March 31, 2025 | The DNIT provided administrative measures related to the application of the RTC . | ||

| General Resolution No. 29 | March 31, 2025 | The deadline for filing the financial statements corresponding to the fiscal year ended December 31, 2024 was exceptionally extended. | ||

| April 2025 | |||

| Regulation | Date | Content | |

| Law No. 7459 | April 14, 2025 | Modifying the rules for the calculation and payment of the municipal vehicle tax in all municipalities of the country. | |

| Law No. 7467 | April 24, 2025 | Special tax rules are provided for Sports Events of International Relevance ("EDRI") and for the entities that organize them. | |

| Decree No. 3814 | April 25, 2025 | Incorporation to the Paraguayan legal system of the accumulation of origin in Mercosur and Bolivia of materials coming from Colombia, Ecuador and Peru. | |

| May 2025 | |||

| Norm | Date | Content | |

| General Resolution No. 30/2025 | May 06, 2025 | The DNIT established the requirements and conditions for the qualification, renewal and update in the registry of persons linked to the customs activity through the Marangatú Tax Management System ("SGTM"). | |

| General Resolution No. 31/2025 | May 27, 2025 | The DNIT established the criteria for the classification of goods included in Chapter 87 of the NCM, on land vehicles; their parts and accessories. | |

MARCH - 2025:

► Decree No. 3465/2025 - The structure of the rules for the registration of persons related to customs activity is modified.

By means of Decree No. 3465, the Executive Power modified key aspects of Decree No. 4672/2005, which regulates the Customs Code. Essentially, what Decree No. 3465 did was to modify Article 17 of the Annex to Decree No. 4672/2005 ("Customs Code Regulations"), which establishes the basis for the registration of persons related to the customs activity, delegating its establishment to the DNIT and repealing the rest of the articles (18 to 97) of the Customs Code Regulations on this matter.

For those who are linked to the customs activity, this implies that, from now on, all persons involved in this sector must register and keep their data updated according to the requirements, guidelines and conditions established by the DNIT, which has been empowered to regulate this registration and clearance, with the indication of incorporating technological advances to optimize the process.

This measure is taken in line with the powers of the DNIT, which, according to Law No. 7143/2023, is the body in charge of applying the customs legislation, collecting taxes, controlling the traffic of goods and setting standards for administrative procedures, among other functions. The autonomy granted to the DNIT allows it to issue these regulations.

► Decree No. 3473/2025 - Modifications to the specific requirements of the ROM for certain NCM codes are incorporated into the Paraguayan legal system.

The ROM is an essential aspect of the customs integration process among the Mercosur member States, since it establishes the requirements for a product, within its respective classification in the NCM, to be classified as originating in Mercosur and, therefore, not to be subject to the Common External Tariff ("CET") and, therefore, to be imported into the corresponding State without payment of customs duties, unless it is included in a National Exception List ("NEL") that allows it.

In view of this, the ROM, as well as the NCM, undergoes constant changes and updates, one of them being the one that occurred in CCM Directive No. 54/2024, which was incorporated into the national legal system by Decree No. 3473/2025.

Details of the amendments to the ROM, by NCM code, can be consulted in the annex to Decree No. 3473/2025, which is available .

► Decree No. 3593/2025 - The Executive Power empowered the MEF to issue resolutions that incorporate to the national legal system the directives of the Mercosur trade commission approving tariff reductions on imports, on an exceptional and transitory basis.

By means of Decree No. 3593/2025, the Executive Power empowered the MEF to implement resolutions to incorporate the directives of the Mercosur Trade Commission. This will allow the application, on an exceptional and transitory basis, of import tariff reductions for those products not included in a LNE.

This initiative seeks to expedite the implementation of temporary tariff reductions previously approved for Paraguay by the Mercosur Trade Commission. The measure is part of Mercosur Resolution GMC No. 49/2019, which allows States Parties to temporarily reduce the CET in situations where it is necessary to ensure the normal and fluid supply of products. Paraguay had already incorporated this resolution to its national legal system through Decree No. 3631/2020.

The MEF, in its role as a member of the National Section of the Mercosur Trade Commission, will now be able to issue these resolutions more efficiently due to their transitory nature. This decision has the approval of the Ministry of Foreign Affairs, the Ministry of Industry and Commerce, and the DNIT.

► Decree No. 3594/2025 - The extension of the expiration of export benefits between Mercosur and Bolivia is incorporated to the Paraguayan legal system.

One of the main trade agreements, if not the main one, is the Economic Complementation Agreement ("ACE 36") of 1996, with its multiple annexes, which has been constantly updated through the respective protocols. ACE 36 contains, among other things, a trade liberalization program between the Mercosur States and Bolivia, as well as rules for the regime of origin and export incentives that allow a total tax exemption for imports between the signatories.

In article 19 of ACE 36 it was agreed that, initially, its trade liberalization program would apply to products that incorporate in their manufacture inputs imported temporarily or under the draw-back regime until 2001, with these types of products not being covered by such benefits since 2002. This term was extended several times by successive protocols, the last one being the Thirty-fourth Protocol, incorporated into the Paraguayan legal system by Decree No. 3594/2025.

According to this protocol, in force bilaterally between Paraguay and Bolivia since April 24, 2025, the trade liberalization program for the products mentioned in the previous paragraph will now be extended until August 7, 2028, which will cease to be benefited from the following day. Thus, the benefits of ACE 36 for such products were extended for almost 3 more years, since the previous expiration date had been set for December 31, 2024 by the Thirty-first Protocol.

► General Resolution No. 26/2025 - DNIT regulated the registration in the RTC.

Through General Resolution DNIT No. 26/2025, the DNIT regulated the registration in the RTC, in which those taxpayers who wish to avail themselves of the benefits of this special regime for the liquidation of the Value Added Tax ("VAT") on the importation and commercialization of certain goods destined to tourists must previously register. For a detailed explanation of the RTC, please click and .

Among the general requirements for the subjects of the RTC, taxpayers must be up to date with their tax obligations, have an active RUC and declare at least one local bank account for the transfer of funds. They must also attach the Certificate of Labor Compliance from the IPS and a certification from the Ministry of Industry and Commerce stating that they are not maquiladora companies, importers with benefits under the raw materials regime or beneficiaries of certain incentive laws.

Importers, traders and intermediaries have additional specific requirements, which, in general, mirror the provisions of Decree No. 2063/2024. Thus, for example, importers must attach bank statements showing an average operating turnover according to their integrated capital, and submit financial statements for the last 2 fiscal years to prove a minimum of 2 years in the commercial circuit. In case of not complying with the antiquity, a bank guarantee of USD 25,000 will be required. Merchants, on their part, must declare the address of their commercial establishment in one of the designated border cities.

Regarding intermediary companies, there are no specific requirements in Decree No. 2063/2024, which established the RTC. However, General Resolution No. 26/2025 added 2 requirements, one formal and one operational: the articles of incorporation or equivalent certification for Simplified Joint Stock Companies, and bank statements verifying an average monthly operational turnover of USD 100,000 or more in the last quarter, must be attached.

The same taxpayer may apply for registration in the 3 categories of subjects: importer, trader or intermediary; providing that only the strictest requirements must be complied with when the requirements for several categories overlap. Thus, for example, when a taxpayer simultaneously applies for registration as an importer and intermediary, it must comply only with the requirements for importers.

Depending on the category of the taxpayer, the application for registration will be verified by the General Directorate of Collection and Taxpayer Assistance or the General Directorate of Large Taxpayers. The DNIT has a term of 10 working days to approve the application and issue the Registration Certificate in the RTC, which will be valid for 2 calendar years.

Taxpayers operating in the RTC will have a term of 10 business days to communicate any modification of the information declared for this regime, applying the maximum fine per contravention (currently Gs.1,530,000) for late communications. This is in stark contrast with the general regime for updating data before the Single Taxpayer Registry ("RUC"), for which the deadline is 30 business days, with a fine per violation of Gs. 50,000 for late communications.

Once registered in the RTC, the affected taxpayers will become information agents and must comply with obligations 947 "Tax Audit" and 923 "Tourism Regime", the latter serving for the presentation of the quarterly reports required by the regime, which may subsist even after the exit from the RTC, until the inventory affected to it is exhausted.

► General Resolution No. 27/2025 - The DNIT provided administrative measures related to the application of the RTC.

The DNIT issued General Resolution DNIT N° 27/2025, establishing new administrative measures for the application of the RTC. This resolution is key for importers and traders operating under this regime in border cities such as Asunción, Ciudad del Este, Encarnación, Pedro Juan Caballero, Pilar and Salto del Guairá.

It provides that importers who registered under the previous Decree No. 1931/2019 and its amendments, and whose registration/renewal certificate expired on March 31, 2025, may continue their customs operations until April 30, 2025.

It is essential that within this period taxpayers manage the renewal of their registration under the new RTC established in Decree No. 2063/2024. They must follow the renewal procedure indicated in General Resolution DNIT No. 26/2025 to obtain the necessary authorization and be able to continue performing customs operations as from May 1, 2025.

► General Resolution No. 29/2025 - The deadline for the submission of financial statements for the fiscal year ended December 31, 2024 was exceptionally extended.

The DNIT has established an exceptional extension for the filing of Financial Statements. This measure applies to taxpayers of the Corporate Income Tax ("IRE") that pay it under the General Regime, whose fiscal years closed on December 31, 2024.

With this resolution, the time limit to file these reports went from April to June 2025, according to the termination number of each taxpayer's tax identifier in the RUC. With this measure, the DNIT seeks to lighten the burden of taxpayers and avoid non-compliance that may result in tax penalties.

It is important to note that this extension is of an exceptional nature. The deadlines for filing the Financial Statements of IRE taxpayers with closing date in April and June 2025 remain unchanged, and they must file them until August and October 2025, respectively.

For the schedule of due dates of the Informative Affidavits (DJI), please refer to article 6 of General Resolution SET N° 38/2020.

APRIL - 2025:

► Law No. 7459/2025 - The rules for the calculation and payment of the municipal vehicle patent tax in all municipalities of the country are modified.

The tax resources of the country's municipalities are composed of a great variety of taxes, fees and contributions. One of these is the annual vehicle tax, which is a partial property tax levied on the owners of vehicles, motorized or not, by the sole fact of their possession or ownership, in the municipality in which such owner has his domicile or establishment.

Until recently, this meant the coexistence of two different tax regimes for vehicle licenses: that of Asunción, governed by Law No. 881/1981 (as amended by Law No. 5817/2017), and that of the other municipalities, governed by Law No. 620/1976 (as amended by Law No. 7447/2025). Thus, while in Asunción this tax was between 0.5% and 0.25% of the taxable value in Customs, depending on the age of the vehicle; in the other municipalities it was between 8 and 0.5 minimum wages, depending on the category and age of the vehicle.

This generated a clear tax competition between Asunción and the other municipalities in terms of vehicle licenses, with the other municipalities being more beneficial for new high-end vehicles, while Asunción was friendlier for used and low-end vehicles. This distortion caused by the different taxation schemes was finally eliminated by Law No. 7459/2025, which unified the taxation of vehicle licenses in all municipalities of the country.

Although the form in which Law No. 7459/2025 was proposed may generate confusion in those who read it, the fact is that it fixed the vehicle license tax in all the municipalities of the country (including Asunción) at 0.3% of the taxable value provided by the National Traffic and Road Safety Agency ("ANTSV"), which will decrease by 0.015 percentage points until the tenth year, as from which the tax will be 0.15%, which is half of what corresponds to new vehicles.

► Law No. 7467/2025 - Special tax rules are provided for EDRIs and for the entities that organize them.

Law No. 7467/2025 established special provisions to attract, promote and regulate the development of EDRIs in Paraguay, and to create a specific legal regime in order to guarantee the necessary conditions for their organization and execution with the standards required for this type of events. Within this framework, the aforementioned law also provided the following tax benefits for EDRIs, their organizers and other persons related, linked, subsidiaries, members and/or affiliated to them:

- Exemption of taxes on the importation of equipment, apparatus, articles and sports implements to be used in EDRIs.

- Enabling of a special regime of temporary admission for all types of equipment, apparatus, articles and sports implements, as well as all promotional material to be used in the event, which will be free from the payment of taxes, contributions, fees or guarantees.

- Exemption from all taxes on the transfer or importation of goods admitted under the special temporary admission regime when they are donated to the National Sports Secretariat or to national or international sports entities recognized by it.

- Exemption of taxes on services rendered in connection with the importation or temporary admission referred to above.

- Exoneration of taxes on the importation of articles related to the organization and development of the EDRI, listed in article 8 of Law No. 7467/2025, in the amounts and for the time fixed by the DNIT.

- Exemption from Income Taxes and VAT on the income received by the organizers and participants of the EDRI, for their performance as such; including the assignment of audiovisual transmission and commercialization rights.

In order for a sporting event to be recognized as an EDRI and give rise to the application of the benefits listed above, it must be declared as such by a decree of the Executive Power. So far this year, there have already been 4 EDRI declarations, instrumented in Decrees N° 3770/2025, 3892/2025, 3909/2025 and 4219/2025, issued for the FIFA Congress, the Pan American Games Jr. 2025, the Paraguay Rally and the World Skate Games 2026, respectively.

► Decree No. 3814/2025 - Incorporates into the Paraguayan legal system the cumulation of origin in Mercosur and Bolivia of materials coming from Colombia, Ecuador and Peru.

Within the framework of ACE 36 between the Mercosur States and Bolivia, Annex 9 establishes the rules of origin that will allow them to implement a total tax exemption for imports between the signatories. Article 7 of this Annex established the rule of "cumulation" of origin, according to which materials originating in one signatory party that are incorporated into other merchandise in the territory of another signatory party will be considered as originating in the latter signatory party.

Additionally, the referred article foresaw the possibility of extending the "accumulation" of origin to third countries members of the Latin American Integration Association ("ALADI") with which the two signatory parties of ACE 36 that intervene in a specific operation have entered into a free trade agreement that exempts the materials in question; subject to each party taking the necessary actions to do so.

Thus, what was originally foreseen as a declaration of "best efforts" of the signatory parties of ACE 36, was materialized in the extension of the "cumulation" rule to materials originating from Colombia, Ecuador and Peru with the Thirty Third Protocol, subject to the rules of the Andean Community for cumulations in Bolivia, and to the respective Economic Complementation Agreements (N° 72, 59 and 58) signed with them by the Mercosur States for cumulations in Mercosur.

This cumulation with Colombia, Ecuador and Peru is effective as of July 24, 2025. It is subject, within the framework of the respective agreements, to the condition that the materials coming from these countries (1) comply with their origin regime; (2) have reached the 100% preference level, without quantitative limits; (3) have a definitive origin requirement; and (4) are not subject to differentiated origin requirements based on agreed quotas.

MAY - 2025:

► General Resolution No. 30/2025 - The DNIT established the requirements and conditions for the qualification, renewal and update in the registry of persons linked to the customs activity through the SGTM.

By means of General Resolution DNIT No. 30/2025 new requirements and conditions are established for the qualification, renewal and update in the Registry of Persons Linked to the Customs Activity in the DNIT ("PVAA" or "PVAA Registry", depending on whether it refers to the subjects or the registry). This measure seeks to modernize and simplify processes, promoting transparency and efficiency in customs operations.

The regulation integrates the technological tools of the General Customs Management ("GGA") and the General Internal Revenue Management ("GGII"). This is expected to reduce time and costs in the management of procedures for the PVAA.

In order to be included in the PVAA Registry, taxpayers with an active RUC must comply with certain requirements. Among them, they must be up to date with their formal obligations and have their RUC updated and in "Active" status. In addition, they must not have expired guarantees or customs liquidations, nor disciplinary sanctions before the GGA. The authorization request is made through the taxpayer's profile in the SGTM, attaching the required documentation in digital format, a list of which can be found in the annex to General Resolution DNIT No. 30/2025, by clicking .

The GGA will be in charge of approving or rejecting the applications within a maximum period of 10 business days. Once approved, the status of PVAA will be reflected in the updated RUC. For certain types of PVAA that require homologation of their electronic information transmission systems, the approval will be finalized once the homologation is completed. It is important to note that the GGA may request additional information, and failure to provide it within 5 business days will result in the rejection of the application.

For those persons who do not have a RUC, the DNIT will grant an identifier in "Canceled" status if they wish to be enabled in the PVAA Registry for customs operations. International transport companies, occasional importers, diplomats and embassies must manage their authorization through the options available on the DNIT website. If a PVAA with RUC "Canceled" decides to operate in the domestic market, it must update its status to "Active".

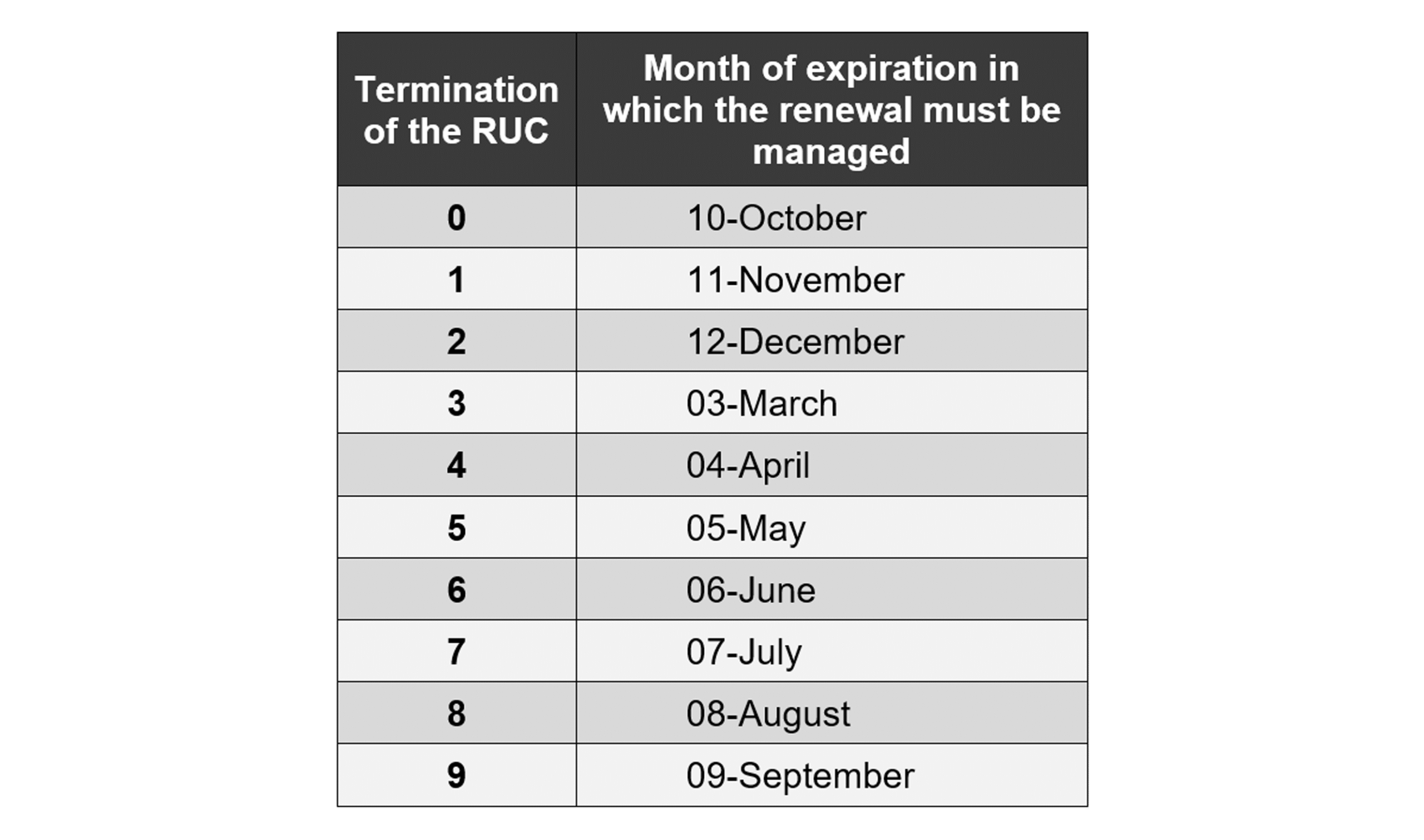

The renewal of the authorization in the PVAA Registry will be annual and will follow a calendar established according to the termination of the RUC, being its authorization in force until the last day of said month, according to the following:

This opens the possibility that certain authorizations in the PVAA Registry, such as the first one made or renewals made after the expiration date, may be valid for more than 1 year, and up to 2 years, inclusive, depending on the interaction between the date of registration and the expiration month foreseen for the year following such registration.

The updating of data in the PVAA Registry is mandatory within 30 working days following any modification, and failure to comply with this term could generate a fine of G. 50,000; matching this to what is foreseen for RUC updates.

The documentary requirements established in General Resolution DNIT No. 30/2025 come into force on the first day of the following months: (1) August 2025 for importers (all categories) and customs brokers, and (2) May 2026 for other PVAA. Qualifications granted prior to these dates will be valid until the last day of the months indicated.

For further information on the PVAA Registry, you may consult the exclusive section that the DNIT has dedicated to this matter by clicking .

► General Resolution No. 31/2025 - The DNIT established the criteria for the classification of goods included in chapter 87 of the MERCOSUR Common Nomenclature ("NCM"), which deals with land vehicles; their parts and accessories.

The DNIT has issued General Resolution DNIT No. 31/2025, which establishes the criteria for the classification of goods of Chapter 87 of the NCM -motor vehicles, tractors, velocipedes and other land vehicles; their parts and accessories- and the application of the corresponding tariff levels for their importation. The objective is to provide greater transparency and predictability to operators dealing with the importation of these goods.

The need to set differentiated criteria to classify goods of Chapter 87 of the NCM is due to the fact that, as from Decree N° 5822/2016, different tariff levels were established, depending on whether or not a vehicle corresponding to one of its headings is classified as a "used good", since to this type of good the ROM allowances would not apply and they would be subject to tariff level provided in the Annex of Decree No. 8015/2022, which is substantially higher than that of their "new" counterparts.

To this end, General Resolution DNIT No. 31/2025 incorporates specific fields in the computer system so that, at the time of the Detailed Import Declaration, it is precisely indicated whether the vehicle is "Recently Manufactured" (Yes/No) and "Unused" (Yes/No).

The resolution defines the following key terms:

- Recently Manufactured Vehicle: The year of manufacture or model must match the year of the Import Clearance or be up to one year earlier.

- Vehicle of non-recent manufacture: The year of manufacture or model is two years or more prior to the year of Import Clearance.

- Unused vehicle: It has not been used since its manufacture or its rolling does not exceed 150 kilometers. Exceptionally, if it exceeds 150 km due to transfers from the manufacturing plant to the point of shipment or Customs, it must be accredited with a certificate from the manufacturer or assembler that includes chassis number, kilometers traveled and commercial invoice.

- Vehicle in use: It has been used since its manufacture and its mileage exceeds 150 kilometers, without complying with the exception mentioned for vehicles not in use.

- Year of Manufacture: Date of manufacture of the vehicle (from January 1 to December 31 of the respective year).

- Model year: Commercial version assigned by the manufacturer, which may coincide with the calendar year of manufacture or the following year, and must be specified in the commercial invoice, catalogs or certificates.

Vehicles that simultaneously meet the criteria of "recently manufactured" and "unused" will be considered new. On the other hand, used vehicles shall be considered those that meet the criteria of "not recently manufactured" or "with use", or both, which shall be subject to the tariff levels of Decree No. 8015/2022.

A curiosity present in General Resolution DNIT No. 31/2025 is the double criterion used to classify vehicles as "recently manufactured" and "not recently manufactured", according to the age of their (i) year of manufacture or (ii) model year. This opens the possibility that unused vehicles that were manufactured up to 3 years prior to their release may be classified as "recently manufactured" if their model year corresponds to the year prior to the year of release (e.g.: release of 2025 on a vehicle with model year of 2024 and year of manufacture of 2023).