| December 2024 | |||||

| Regulation | Date | Content | |||

| Law No. 7408 | December 30, 2024 | 2025 Budgetary limits for the National Directorate of Tax Revenues ("DNIT") to credit amounts for undue or excess payments, interest and surcharges. | |||

| Decree No. 3165 | December 23, 2024 | Real estate tax values for the taxable base of the real estate tax and its additions, corresponding to fiscal year 2025. | |||

| Law No. 6380 | September 25, 2019 (Update) | Validity of the limit for withholdings on account of Value Added Tax ("VAT") for local suppliers. | |||

| January 2025 | |||||

| Norm | Date | Content | |||

| Decree No. 3237 | January 16, 2025 | Relaxation of the requirements for importers under the Buying Tourism Regime ("RTC"). | |||

| Decree No. 3108 | December 19, 2019 (Update) | Percentage of guarantees to be submitted for the accelerated VAT refund regime by 2025. | |||

| General Resolution DNIT N° 01 | January 12, 2024 (Reminder). | Legal entities that register as new taxpayers in the Single Taxpayer Registry ("RUC") must issue their vouchers only electronically. | |||

| February 2025 | |||||

| Rule | Date | Content | |||

| Decree No. 3339 | February 10, 2025 | Incorporation to the Paraguayan legal system of the extension to the limit of changes in the lists of national exceptions to the Common External Tariff ("CET") of the Southern Common Market ("Mercosur"). | |||

| Decree No. 3379 | February 21, 2025 | Incorporation into the Paraguayan legal system of the amendments to the Mercosur Common Nomenclature ("NCM") and its corresponding CET. | |||

DECEMBER - 2024:

► Law No. 7408/2024 - The 2025 budget limits are established for the DNIT to credit amounts for undue or excess payments, interest and surcharges.

Law No. 7408/2024 approved the General Budget of the Nation ("PGN") for fiscal year 2025 and, with it, established several tax measures that, to a greater or lesser extent, affect taxpayers. One of these measures (Articles 235 and 236 of the PGN) are the annual budgetary limits for crediting taxpayers for balances due to:

- for undue or excess payment,

- VAT refunds purchased from non-profit entities ("ESFL"), and for accessories in the following recovery processes

- for accessories in the following tax credit recovery processes:

- VAT refund (exporters, export freight forwarders, Yacyretá suppliers, etc.),

- repetition due to undue or excess payment and

- refund of VAT purchased from the ESFLs.

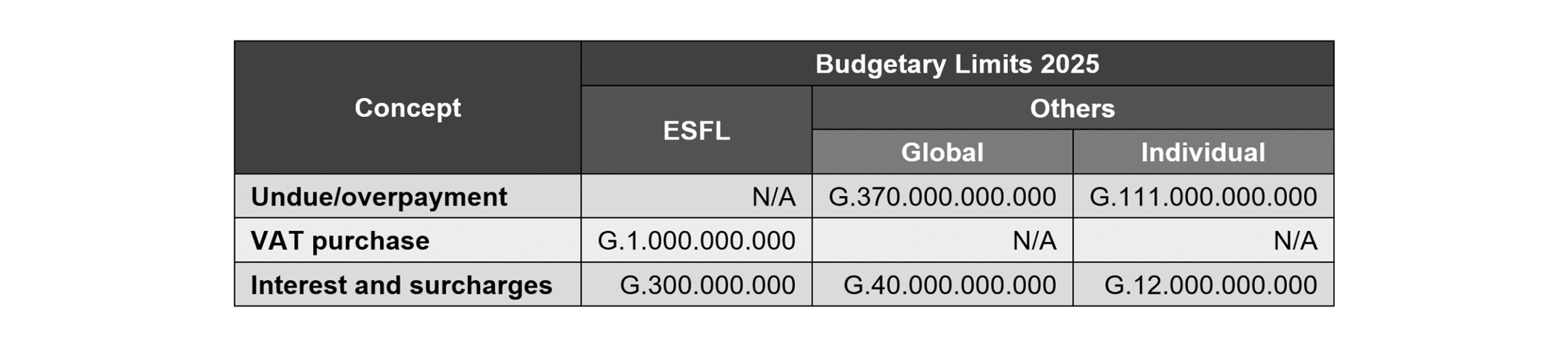

This is a budgetary measure that has been implemented every year since Law No. 5061/2013 (see Article 7) and Decree No. 850/2013. For this fiscal year 2025 the overall and individual (per taxpayer) budget limits are the same as for fiscal years 2023 and 2024, being the following:

The global limits represent the maximum amount that DNIT can credit in the indicated concepts during the whole fiscal year 2025, while the individual limits per taxpayer are 30% of the global limit for each concept. This means that no taxpayer may represent a higher percentage of credits than indicated, thus avoiding that only one taxpayer excludes the others.

These budgetary limits do not apply to VAT refunds purchased from NPOs as a result of court rulings, as these have their own limits. Furthermore, the way in which this concept is credited to NPOs also differs from the normal regime, since these amounts are paid in cash, and not with credit to the taxpayer's current tax account, as occurs in the other cases.

In the event that the budgetary limits are reached during the fiscal year, the amounts pending crediting are deferred to the following fiscal year without generating legal accessories (interest, etc.). The area responsible for making the credits must correlatively record the resolutions that provide for them, for their inclusion in the PGN of the following fiscal year.

► Law No. 6,380/2019 - Seeks to extend the validity of the limit for VAT withholdings on account for local suppliers (UPDATE).

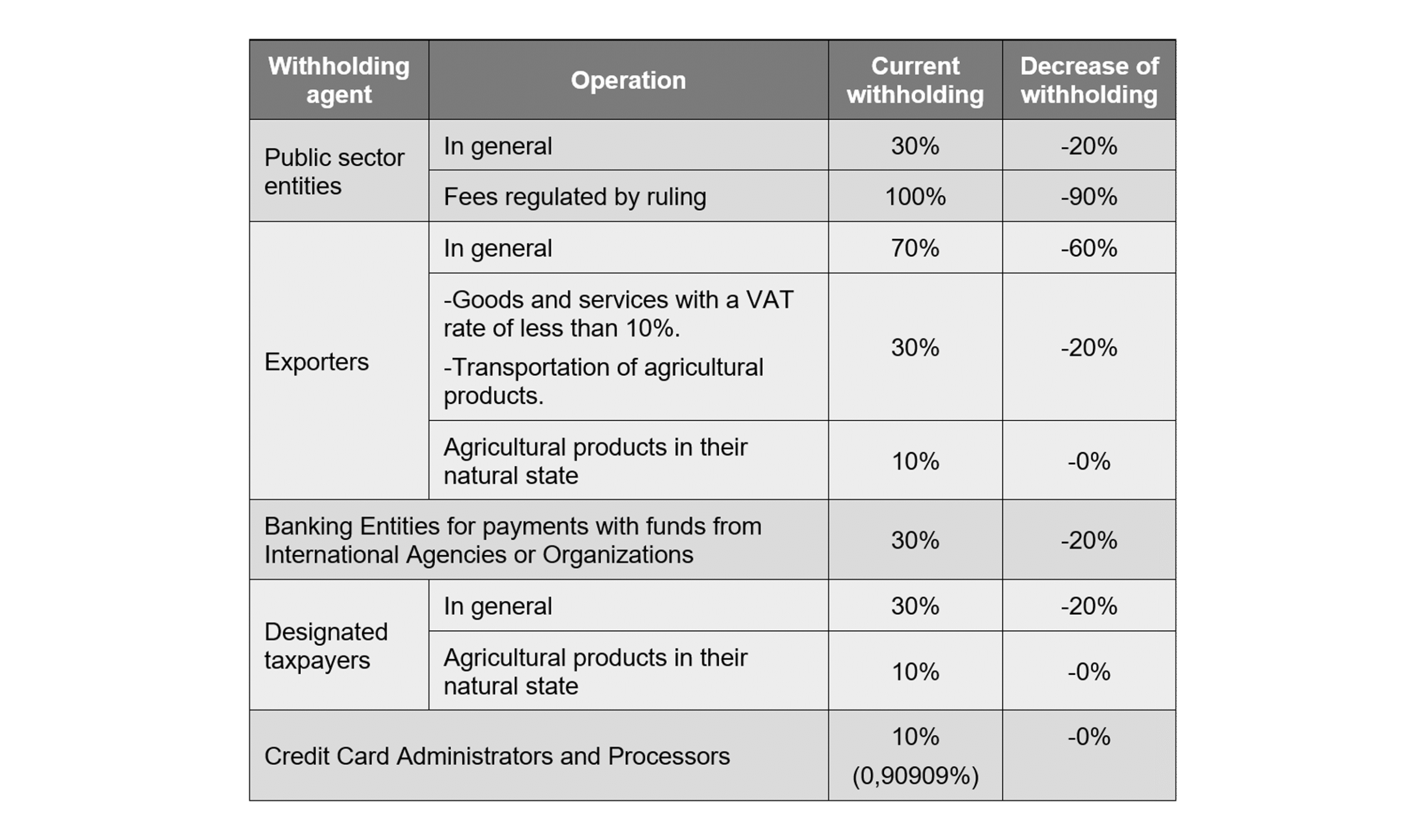

Law No. 6380/2019 ("Tax Law") introduced several short and medium term novelties to the national tax regime. One of them was the limit for VAT withholdings on account, provided for in the first paragraph of its Article 136. This limit was set at 10% of the tax stated in the sales receipt.

The Tax Law provided for the application of such limit as from the fourth year of its effectiveness, and due to the fact that the Tax Law became effective on January 1, 2020, the date for the implementation of the withholding limit was set for January 1, 2023. In other words, the application of this withholding limit was deferred from 2020 to 2023.

This decrease in the withholding percentage has great consequences for taxpayers that are VAT withholding agents, since they must adjust their systems to the new limit. Among such taxpayers are the following:

In addition to the withholding limit, the second paragraph of article 136 of the Tax Law provided for the progressive reduction of the percentage of VAT withholding on account as from the year following the effective date of the Tax Law and until the deadline for applying the withholding limit is met, i.e., from 2021 to 2022.

However, this progressive reduction was conditioned to the issuance of a decree of the Executive Power providing the schedule for such purpose, but since this did not happen, the withholding limit should have been in force all at once, without any progressive adjustment. Moreover, in Article 275 of Law No. 6873/2022, Article 287 of Law No. 7050/2023 and Article 285 of Law No. 7228/2023, which approved the PGN 2022, 2023 and 2024, respectively, the decrease was suspended for those years; which, curiously, was replicated again for this 2025 with Article 261 of Law No. 7282/2023, which approves the PGN for that fiscal year.

The inclusion of this suspension in the laws of the PGN 2023 to 2025 appears as an error that may generate confusion among individuals, since it refers to a rule that is no longer in force for those years, because the progressive decrease was a transitory provision that could only be implemented from 2021 to 2022, but no longer from 2023, since from then on it no longer makes sense, because the withholding limit is applied.

It would be appropriate for the DNIT to come out on top of this and issue ex officio a resolution clarifying the confusion that could be generated due to the referred suspension, even more so when this situation has been occurring since 2023, with the market operating as if the limitation of withholdings were not in force.

► Decree No. 3165/2024 - Whereby the real estate tax values are set for the taxable base of the real estate tax and its additions, corresponding to fiscal year 2025.

By means of Decree No. 3165/2024, the Executive Branch fixed the real estate tax values established by the General Directorate of the National Cadastre Service ("DGSNC") of the Ministry of Economy and Finance, which will serve as the taxable base for the determination of the real estate tax and its additions for the fiscal year 2025.

The adjustment made implies an increase of 3.6% in real estate values, both for urban and rural properties, based on the inter-annual variation of the CPI at the end of October 2024, as reported by the Central Bank of Paraguay.

It is important to remember that the amount of the tax is determined by applying the corresponding rates (normally 1%) on the fiscal valuation of the real estate established by the DGSNC (taxable base), which is made up as follows:

- Urban real estate: land value (m2 of the real estate per G/m2) plus built value (m2 of the buildings per G/m2). The G/m2 is determined by the type of pavement with the highest value of the adjoining streets (fronts) of the property for the land value, and by the construction category for the buildings.

- Rural properties: Land value (hectare ("ha") of the property per G/ha). The tax valuation of each district is determined according to its opportunity cost (distances to urban centers and accessibility) and the predominant type of soil, according to the categories indicated in the decree.

It also provides, among other things: the valuation of properties that change from urban to rural category and vice versa, the procedure for the exemption of 50% of the tax for rural properties with forestry priority or with real right of forestry surface, and the discount for rural properties with low productive areas that differ from the type of soil of their district.

The amount of the tax to be paid to the municipality can be consulted through the DGSNC website, in the municipalities section, real estate tax liquidation section, subsequently selecting the department of residence, the district and the cadastral nomenclature of the property (padrón or current account).

JANUARY - 2025:

► Decree No. 3,237/2025 - Requirements for importers under the RTC are relaxed.

The RTC was established by Decree No. 2063/2024, providing for the intervention of 4 subjects, of which 2 would be taxpayers registered before the DNIT that would operate commercially under such regime. These taxpayers were classified, according to their function, as (1) traders and (2) importers ("RTC Importers"), the specific requirements for the latter being stricter, which were revised and made more flexible in Decree No. 3237/2025 ("RTC-2 Decree").

Originally, RTC Importers could not operate as such if they had not been in the commercial circuit for at least 2 years; however, Decree RTC-2 changed this, allowing companies with less than 2 years to operate by presenting a bank guarantee of USD 25,000 or its equivalent in guaranies, valid for at least one year from the date of the application, to cover their possible liability for tax or customs infractions.

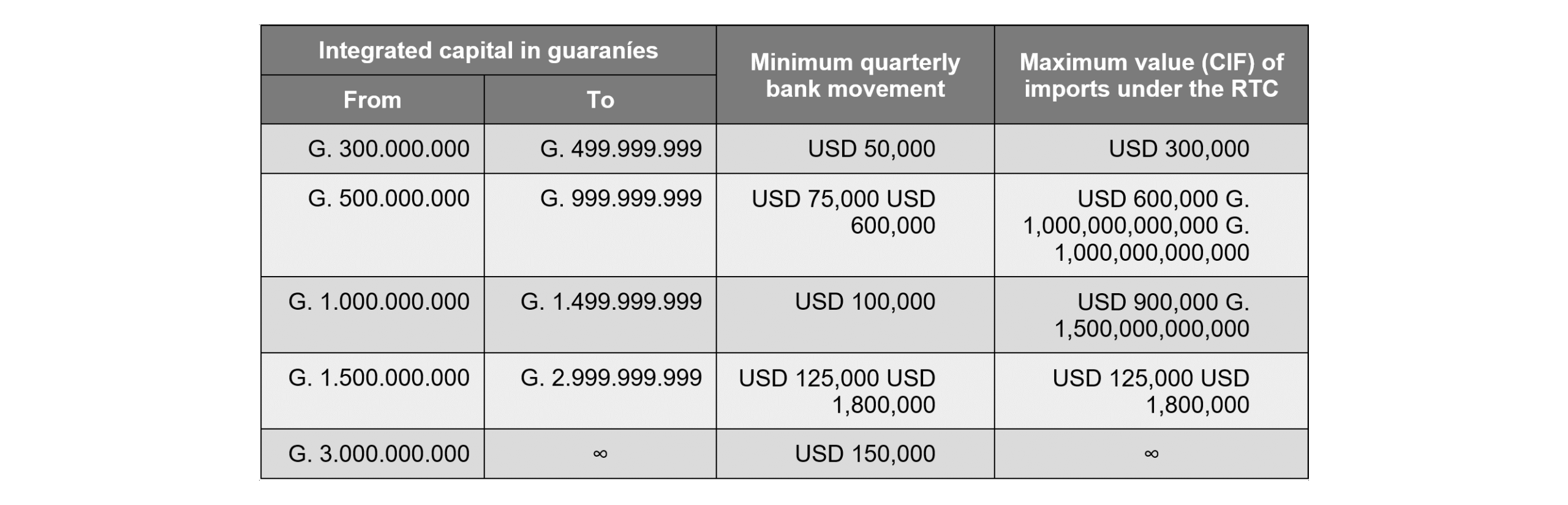

Another change introduced by Decree RTC-2 with respect to the requirements for RTC Importers consists in the reduction of the minimum integrated capital required of them, since it was originally G. 6,000,000,000 and now it has been reduced to G. 300,000,000, but with limitations up to G. 3,000,000,000,000 of integrated capital. This is because the reduction of the minimum integrated capital was linked to the reduction of the minimum banking movement in the last quarter -which was originally USD 200,000-, and to the establishment of a limit of imports according to the integrated capital, as follows:

In addition to the above, Decree RTC-2 extended the validity of the habilitations under the previous tourism regime of Decree No. 1931/2019, which would now expire on a future date to be set by the DNIT, instead of as of the effectiveness of Decree No. 2063/2024 in July of that year, as originally foreseen.

Another innovation of Decree RTC-2 consists in providing that the DNIT will prepare a risk profile of the RTC taxpayer, including that of its related persons (representatives, main shareholders or partners), which will be taken into account during the processes of continuous monitoring of the importers' compliance with their obligations.

Finally, Decree RTC-2 provided that the DNIT will proceed to suspend the status of beneficiary of the RTC of those taxpayers with respect to which any of the following situations are detected during a control or verification process:

- The beneficiary of the RTC or his legal representatives are not located at the domicile declared in the RTC registry.

- The importer or his legal representatives do not attend the summons made by the DNIT without a duly justified cause.

- The importer or its legal representatives ignore one or more requirements made by the DNIT.

The suspension to operate under the RTC will be lifted once the situation or situations that gave rise to this measure are remedied in the manner and conditions to be determined by the DNIT.

If you wish to learn more about the RTC and Decree No. 2063/2024 that established it, we invite you to read the article published about it on this website by clicking .

► Decree No. 3.108/2019 - The percentage of guarantees to be submitted for the accelerated VAT refund regime is set for 2025 (UPDATE).

Article 102 of the Tax Law provided that exporters and freight forwarders may request the accelerated refund of the VAT credit affected to their export or export freight operations, presenting for this purpose a bank guarantee, financial guarantee or insurance policy with a minimum validity of 90 business days from the date on which the refund request is filed.

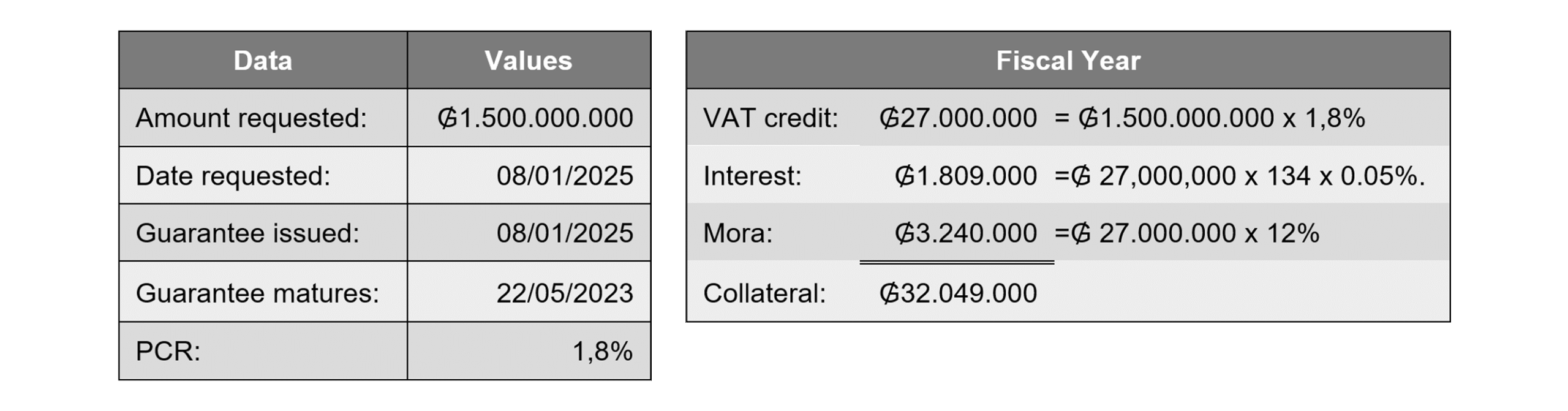

For the first 3 refund requests under the accelerated regime, the guarantee must cover 100% of the capital of the VAT credit required to the DNIT, plus accessories. From the fourth application onwards, the guarantee must only cover the portion of the VAT credit resulting from the average percentage of rejected credits ("PCR") under the accelerated regime in the months from January to November of the previous year, plus accessories.

To establish the value of the guarantee, the applicant must multiply the PCR by the VAT credit for which a refund is requested. The following legal accessories must be added to the resulting amount, calculated until the expiration date of the guarantee on the amount of the VAT credit resulting from the PCR: daily interest of 0.05% and late payment penalty of 12%.

The DNIT publishes the PCR annually, and on this occasion the PCR was set at 1.8% for 2025. This PCR represents a decrease of 168 basis points (-1.68%) with respect to 2024, which is practically a reduction by half of the 3.48% set for last year. This brings it back to levels similar to 2023, whose PCR was 1.75%. DNIT included the following example of a calculation for the guarantee with this publication:

A more direct way of expressing the total guarantee coverage as a percentage of the credit VAT is achieved by expressing the accessories as percentages of the PCR. This is achieved by estimating the interest at 6.7% (134 days times 0.05%) and the late payment penalty at 12%, which added together arrive at 19.7% of the PCR, which can be rounded up to 20%. To add this percentage directly to the PCR, it must be expressed as 1.20 times the PCR, which for a PCR of 1.8% means a total guarantee of 2.16% of the VAT credit.

In the cases in which the bank, financial or insurance policy guarantee is lower than the amount rejected, the taxpayer must immediately pay the difference in favor of the Treasury, plus the legal accessories that will be calculated until the total payment.

► Resolution No. 01/2024 - Legal entities that register as new taxpayers in the RUC must issue their vouchers only electronically.

By means of General Resolution DNIT N° 01/2024, it was provided that as from January 01, 2025, legal entities that register as new taxpayers in the RUC may only issue their vouchers electronically, through the E-Kuatia system or the E-Kuatia'i system, with the exception of the virtual withholding voucher.

In order to guarantee this measure, the resolution also establishes that, as of the aforementioned date, the DNIT will no longer issue stamps for means of generating vouchers other than electronic ones, with the exception of the aforementioned virtual withholding voucher.

This modified the provisions of General Resolution No. 105/2021, which had established January 1, 2024 as the starting date of the measure. The reason responded to the objective of achieving a sustainable and gradual implementation of the Integrated National Electronic Invoicing System ("SIFEN"), whose general regulations were updated in December 2023, by Decree No. 872/2023.

In this way, the generalized application of electronic invoicing is complied with 3 months after the mandatory calendar foreseen in Article 1 of General Resolution SET No. 105/2021, whose last date of application, foreseen for Group 10 in the mandatory scheme, was October 1, 2024. Thus, the new taxpayers affected by this measure become a sort of Group 11 of electronic invoicing.

FEBRUARY - 2025:

► Decree No. 3,339/2025 - The extension to the limit of changes in the lists of exceptions to the Mercosur CET is incorporated to the Paraguayan legal system.

The CET seeks to establish a uniform customs charge of all Mercosur member states towards goods from third countries within the framework of its regional integration process. However, due to the disparity of development among the different States parties and the need for economic competitiveness in the region, CMC Decision No. 58/10 foresaw that each State may establish a list of exceptions to the CET, within the following limits:

- It cannot exceed a certain number of NCM codes, set for each particular State (Paraguay's limit is 649 NCM codes).

- It cannot extend beyond a certain deadline, set differently for each State (Paraguay's deadline is December 31, 2030).

- No more than 20% of the NCM codes included in the exception lists may be modified every 6 months (Paraguay's limit would be 129 NCM codes).

This last limit of modification to the number of NCM codes that may be modified as part of the lists of exceptions to the CET limits the capacity of Mercosur member states to adapt their customs policy instruments to their specific conjunctural needs. In view of this, CMC Decision No. 12/23 was issued, which authorizes the States Parties to suspend that limit until December 31, 2025, which was internalized by Paraguay through Decree No. 3,339/2025.

► Decree No. 3,379/2025 - Several amendments to the NCM and its corresponding CET are incorporated into the Paraguayan legal system.

The NCM is an instrument of economic and customs policy of the Mercosur member States that is constantly changing and adapting to the technical and economic needs of Mercosur as a bloc. In view of this, it undergoes constant changes and updates, some of which occurred in GMC Resolutions No. 05/23, 27/23, 28/23, 29/23, 30/23, 31/23 and 39/23, all of which were incorporated into the national legal system by Decree No. 3379/2025.

Details of the NCM codes modified by those resolutions can be found in the annex to Decree No. 3379/2025, which is available .