Executive Summary

| August 2025 | ||

| Regulation | Date | Content |

| Law No. 7508 | July 28, 2025 | Vaporizers and nicotine-free essences are included in the category of cigarettes and tobacco products subject to the Selective Consumption Tax ("ISC"), and the minimum tax rate limit for those products is increased. |

| General Resolution No. 35 | July 24, 2025 | The National Tax Revenue Directorate (“DNIT”) extended the deadlines for registration in the Registry of Persons Linked to Customs Activities (“PVAA”). |

| 2026 National General Budget Bill | August 25, 2025 | The Executive Branch submitted the draft General National Budget for 2026 ("PGN") to Congress. |

| Binding Consultation No. 712 | August 2025 | Extension of the useful life of biological assets in plantations. |

| Binding Consultation No. 709 | July 2025 | Aspects related to electronic bills of exchange. |

| Binding Consultation No. 694 | May 2025 | Tax treatment of refunds made by the parent company abroad. |

| Binding Consultation No. 678 | April 2025 | Limitation on the deductibility of self-assigned remuneration of the owner of a sole proprietorship. |

August – 2025:

► Law No. 7508/2025 – Inclusion of nicotine-free vapes and essences in the category of cigarettes and tobacco products, and increase in the minimum ISC rate for those products.

The Executive Branch enacted and published Law No. 7508/2025 in the Official Gazette, establishing health measures related to Electronic Nicotine Delivery Systems (“ENDS”), Similar Non-Nicotine Delivery Systems (“SNDS”), and other similar devices, commonly referred to as vapes, vaporizers, or electronic cigarettes. These measures include a tax measure consisting of the inclusion of (1) vaping devices and (2) their vaporizable liquids, with and without nicotine, in the category of cigarettes or tobacco products taxed by the ISC, whereas previously only tobacco products used in vaping devices were taxed.

In addition, the minimum rate for vaping devices and their essences was also increased from 18% to 22%, thus restricting the Executive Branch's power to reduce the ISC rate for these goods, while keeping it intact for other products in the same category, such as cigarettes, tobacco, etc. In practice, this will not have an im y impact, as the rate for all products in this category has already been set at 22% by Decree No. 8878/2023.

What would have an immediate impact is the new ISC tax on imports of vaping devices without essences and nicotine-free essences for vaping devices, to which a 22% surcharge is immediately added. This is an issue that importers in this sector, in particular, should pay close attention to and consider in their day-to-day operations.

► General Resolution No. 35/2025 – Extension of the validity periods for registrations in the PVAA registry.

The DNIT issued General Resolution No. 35/2025, introducing adjustments to the regulations governing the authorization, renewal, and updating of PVAA. The measure complements the provisions of General Resolution No. 30/2025 regarding the validity of registrations for importers and customs brokers.

Now, registrations for regular importers, aircraft maintenance and repair companies, and duty-free shops valid as of March 1, 2025, will be extended until October 31, 2025, rather than August 31, 2025, as initially planned. Thus, the deadline for completing this procedure before these registrations expire has been extended from one to three months. For other types of PVAA, registration remains valid until May 31, 2026, with one month to complete the procedure.

An interesting feature of the new mandatory registration schedule for the PVAA registry is that the categories of "Occasional Importer" and "Diplomats" have been eliminated, which means that registrations in these categories would not be affected by the previously indicated expiration dates, although the obligation to begin the renewal process as of August 1, 2025, remains in effect.

The resolution also provides for the possibility of the General Customs Administration authorizing exceptional treatment in duly justified cases, allowing for the partial submission of requirements without interrupting essential foreign trade operations. With these modifications, the DNIT seeks to provide greater predictability to international trade actors, while ensuring the collection of taxes and the continuity of customs operations.

► The Executive Branch sent the PGN for 2026 to Congress.

On August 25, 2025, the Executive Branch presented the General National Budget for 2026 (the "PGN") to Congress, which will be reviewed for approval. Revenues are estimated at PYG 149.17 trillion (USD 20.896 billion), while the estimated fiscal deficit for fiscal year 2026 stands at 1.5% of GDP for the Central Administration, thus returning to compliance with the limits established in Law No. 5098/2016 on fiscal responsibility.

The Executive's Message adds that the tax burden would be 11.6% of GDP and tax collection would grow by 8% compared to 2025. Real GDP growth in 2026 is projected at 3.8%. No changes or eliminations of exemptions are expected, meaning that tax policy will remain stable in 2026.

The PGN bill sets limits on bonuses and prohibits gratuities, except for officials of the National Tax Revenue Directorate (DNIT). It also provides for the obligation to use the National Development Bank (BNF) for inter-institutional payments and compensation without affecting tax revenues.

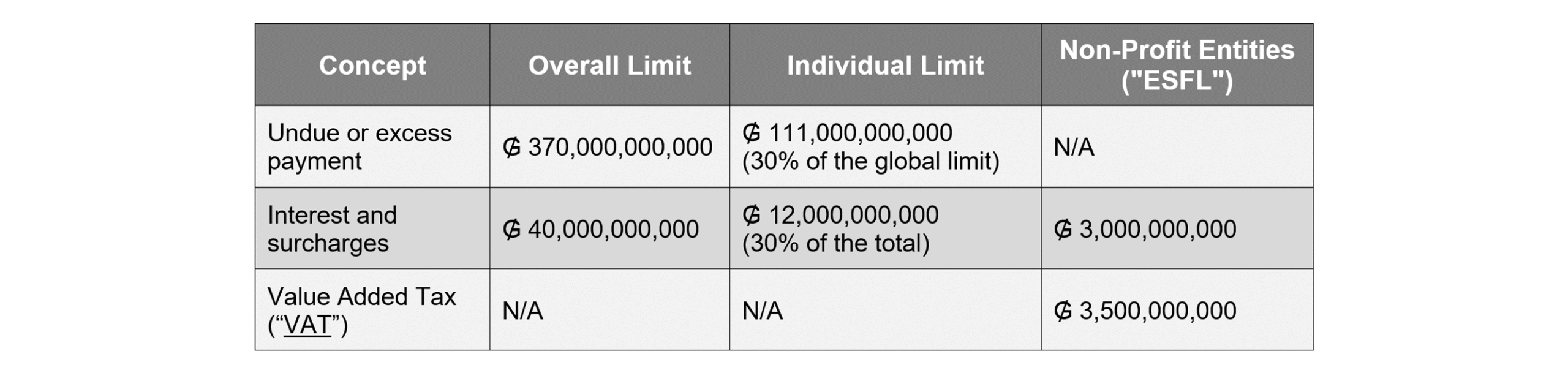

The PGN also provides for tax measures, one of which is annual budget limits for crediting taxpayers with the balances due to them for (1) undue or excess payments and (2) legal accessories. This is a budgetary measure that has been implemented every year since Law No. 5061/2013 (see Article 7) and Decree No. 850/2013. For fiscal year 2026, the PGN bill establishes the following overall and individual (per taxpayer) budget limits:

The overall limits represent the maximum amount that the DNIT can credit for the items indicated throughout the 2026 fiscal year, while the individual limits per taxpayer are 30% of the overall limit for each item. This means that no taxpayer can represent a percentage of credits greater than that indicated, thus preventing one taxpayer from excluding the others.

These budget limits do not apply to VAT refunds to ESFLs as a result of court rulings, as these have their own limits. In addition, the way in which this item is credited to ESFLs also differs from the normal regime, as these amounts are paid in cash and not credited to the taxpayer's tax account, as is the case in other instances.

If the total budget limits are reached during the fiscal year, the amounts pending credit are deferred to the following fiscal year without generating legal accessories. The area responsible for making the credits must correlatively record the resolutions that provide for them, for inclusion in the PGN for the following fiscal year.

► Binding Consultation No. 712 – Extension of the useful life of biological assets in plantations

The DNIT was consulted regarding the possibility of extending the useful life of the Neem tree plantations that make up a company's fixed assets, with the aim of starting their depreciation in 2024, extending the depreciation period to 20 years from then on, and recognizing this expense as deductible in the determination of the IRE.

In its ruling, the DNIT decided to authorize the requested extension, establishing that the plantations in question may be depreciated over a period of 20 years. It also ruled that the depreciation from these assets will be deductible for income tax purposes starting in fiscal year 2025, although, unfortunately, it did not elaborate further on the start date of the depreciation of the plantations, which, according to Article 30, paragraph 2, of the annex to Decree No. 3182/2019, is from the first harvest or cut.

The decision is based on the powers provided for in the last paragraph of Article 31 of the Annex to Decree No. 3182/2019, which allows the DNIT to set a useful life other than that specified in the regulations when supported by a technical report.

The resolution highlights that the useful life of biological assets is directly linked to the calculation of depreciation, which requires determining both the period of use and the residual value of the asset. In this case, the firm provided technical reports demonstrating that the cultivated species has a useful life of 20 years, exceeding the 5 years originally provided for in the regulations.

The DNIT specified that the authorization is limited exclusively to the assets identified in the application and is not extendable to other similar assets that have not been subject to technical analysis. Finally, it recalled that, in order to be deductible, depreciation must comply with the general requirements established in Article 14 of Law No. 6380/2019: it must be necessary to maintain the source of production, represent an actual expenditure, be properly documented, and be in line with market value.

This ruling confirms the importance of technically supporting any request to modify the useful life of depreciable or amortizable assets, especially in the case of biological assets whose productivity may vary depending on operating conditions.

► Binding Consultation No. 709 – Aspects relating to electronic bills of exchange.

In a recent binding consultation, the DNIT was asked whether it was possible to incorporate the fields provided for in Law No. 6542/2020 on bills of exchange into the electronic invoice format in order to guarantee the validity of such documents as enforceable instruments in the event of legal collection.

In addressing this issue, the DNIT distinguished between information on the exchange invoice that is validated by the Integrated National Electronic Invoicing System ("SIFEN") and information that is not, the former being either mandatory or optional. It is this validatable information that is sent to the SIFEN, as provided for in the current technical documentation. Consequently, any electronic invoice that includes bill of exchange information that differs from that provided for in the technical documentation will not be approved by the system.

The current version of the SIFEN technical documentation strictly establishes the fields that can be included, and these do not include those relating to the assigned debt, as required by Law No. 6542/2020. However, the regulations do allow space on the electronic invoice for the inclusion of additional information from the issuer (field J003, up to 5,000 characters in length), in which any other information that the issuer deems relevant may be included, such as that required by Law No. 6542/2020.

This data may appear in the electronic document or in its graphic representation (“KuDE”) sent to the customer, but it is not included in the XML file sent to SIFEN for validation, nor will it form part of the electronic tax document approved by SIFEN. In summary, taxpayers seeking to issue exchange invoices must take into account the distinctions made between validatable and non-validatable information for the purposes of including the relevant information.

► Binding Consultation No. 694 – Tax treatment of refunds made by the parent company abroad.

The DNIT issued a ruling on the tax treatment applicable to reimbursements received from its parent company in Spain. The operation consisted of the branch in Paraguay advancing certain expenses—such as hiring personnel, market studies, and technical support—which were subsequently reimbursed by the parent company under a contract called a "transitional mandate." The company understood that these amounts did not constitute taxable income and, consequently, should not be subject to VAT, Corporate Income Tax ("IRE"), or Non-Resident Income Tax ("INR").

The DNIT concluded that the reimbursements in question did not correspond to a mandate contract, but rather to the provision of services, which meant that they were subject to the local tax regime. In particular, it determined that:

- The transactions must be framed within the Special Rules for the Valuation of Transactions, given the nature of related parties.

- The agreed profit margin will be subject to INR, although it should have referred to IRE, since this margin would belong to the local branch.

- The amounts paid by the parent company to the branch are subject to VAT, as they constitute services used in Paraguayan territory.

- Payments to suppliers in Brazil will be subject to INR and VAT when the services are used or exploited in Paraguay and are linked to income taxed by the IRE.

To reach this conclusion, the DNIT examined the contract submitted, which expressly defined the relationship as a provision of services aimed at market opening, technical support, and administrative management in Paraguay and Brazil. In view of this, it considered that this was not a mere reimbursement under mandate, but rather a scheme of services provided to the foreign parent company.

The DNIT also pointed out that, as the parties were related, the transaction had to comply with the principle of independence set out in Law No. 6380/2019, so that the prices and conditions were comparable to those that would have been agreed by independent parties in similar circumstances. Finally, it insisted that the documentation must accurately reflect the concepts of "reimbursement" and the corresponding expenses in order to adequately support the accounting and settlement of taxes.

With this ruling, the DNIT sets an important precedent: reimbursements from the parent company to the local establishment, when related to the provision of services, are subject to IRE, INR, and VAT under the conditions indicated.

► Binding Consultation No. 678 – Limitation on the deductibility of self-assigned remuneration of the owner of a sole proprietorship.

The DNIT has issued a response to a binding consultation addressing the deductibility of self-assigned remuneration by the owner of a sole proprietorship, in their capacity as a taxpayer of the IRE and Personal Income Tax ("IRP"). The consultant wanted to know whether, when paying IRP on his remuneration as the owner of the sole proprietorship, this was deductible only up to 1% of gross income on the General IRE form.

The DNIT concluded that the deductibility of self-assigned remuneration in the IRE depends on the type of service provided by the owner:

- 100% deductibility: If the remuneration is received for independent personal services, the entire amount is deductible in the IRE. This deduction applies as long as the service provider (a) is an IRP or INR taxpayer, and (b) is not considered "senior staff" of the company.

- Deductibility limited to 1% of gross income: If the remuneration is received as senior personnel, the deduction will be limited to 1% of the company's gross income for the fiscal year, regardless of whether or not the owner is an IRP taxpayer, which allows for greater flexibility than that provided for in the regulations.

In this regard, the DNIT clarified that the total deduction (100%) for independent personal services applies if the owner, partner, or shareholder, who is an IRP or INR taxpayer, receives remuneration for the provision of such services to himself in his capacity as a sole proprietor, which must be duly documented by means of a contract and a sales receipt to justify the total deductibility. In this way, the DNIT seems to be indicating that this would be possible if a person contracts with themselves for services other than those of the senior staff of the sole proprietorship.